Economic stagnation arrives as expected as the “Sugar Rush“ of liquidity continues to fade from the system.

Before we review what wrote in March 2021, Goldman Sachs just slashed their GDP growth rates for 2022.

“Specifically, the bank slashed its Q1 GDP forecast from 2.0% to just 0.5%, and while the bank fudged the other quarters modestly higher, it lowered its 2022 annual average GDP forecast by 0.2% to +3.2% (vs. +3.8% consensus) while warning that “the annual average masks the sharp deceleration in growth from 2021 into 2022, which is better captured by the 2022 Q4/Q4 rate, which we now expect will be +2.2% (previously +2.4%).” – Zerohedge

What was the reasoning for this economic stagnation after very exuberant expectations previously?

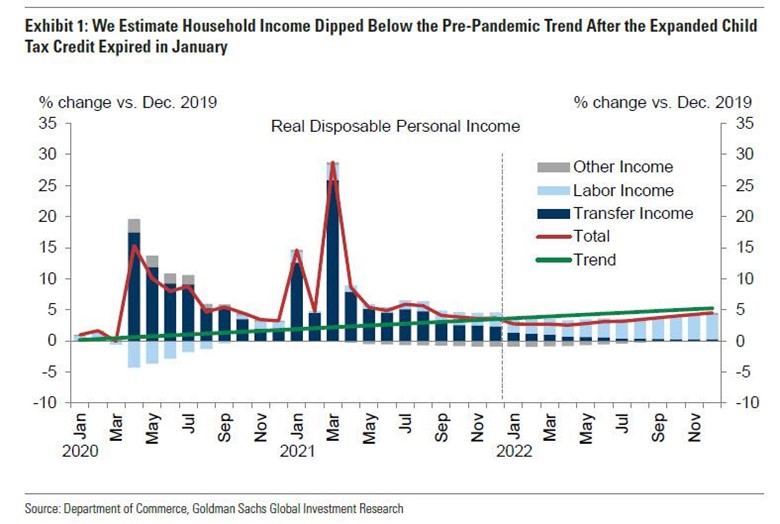

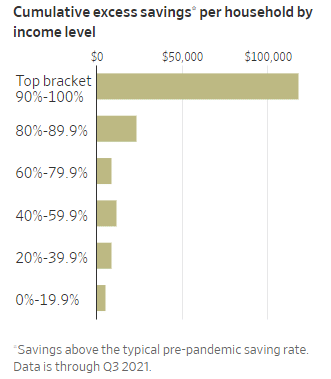

“Goldman calculates that fiscal support boosted real disposable income to 5% above the pre-pandemic trend on average in 2021. But following the lapse of the expanded child tax credit this month, disposable income has likely dipped below trend. It will remain an average of 1% below the pre-pandemic trend in 2022 even after penciling in strong gains in labor income. As Goldman’s Jan Hatzius writes, ‘this decline should weigh on consumer spending. It is a large part of why we expect growth to slow to only slightly above potential by the end of the year. However, the impact should be cushioned by the spending of excess savings built up during the pandemic that still total nearly $2.5 trillion.“ – via Zerohedge

While Goldman is still optimistic overall, the problem with their assumption, as noted by the WSJ, is that the bottom 90% of Americans don’t have much in savings. It belongs almost entirely to those in the top-10%.

However, when it comes to GDP growth, it is the bottom 80% that drives the economy.

The Sugar Rush

Now let’s review what we wrote at the beginning of March last year. I have updated the graphics.

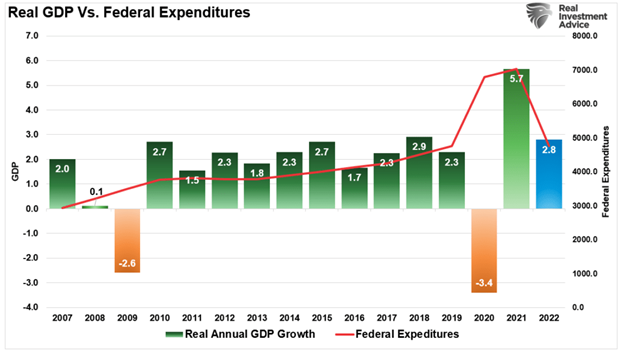

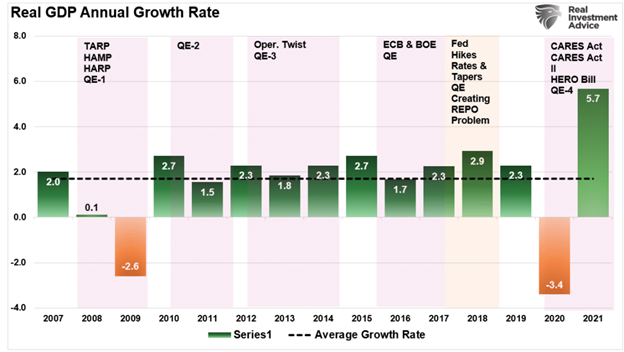

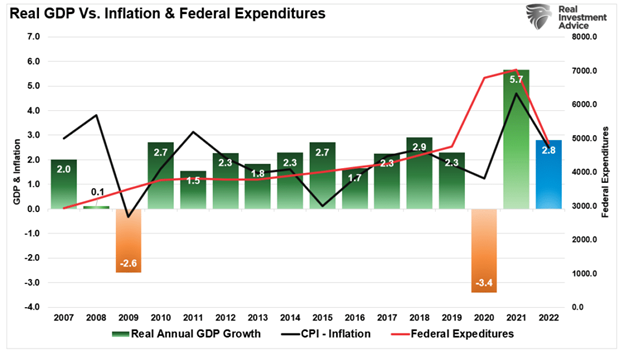

“Here is the more significant issue. The vast majority of the growth in the U.S. over the last decade was due to a variety of artificial inputs which are not indefinitely sustainable. From increasing federal expenditures:”

“to a litany of ‘bailouts,’ which are a function of increased debts and deficits and massive monetary interventions.”

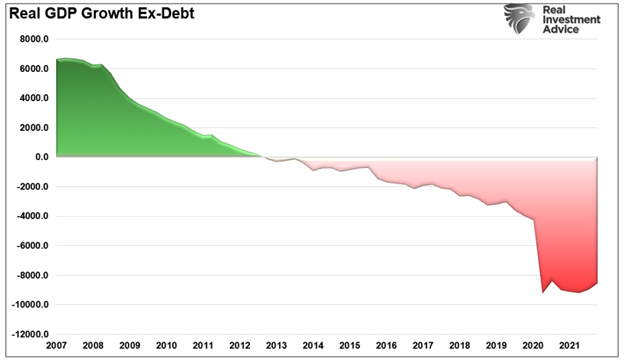

“While the economy ‘appeared’ to grow during this period, economic growth would have been ‘negative’ without debt increases. The chart below shows what economic growth would be without the increases in Federal debt.

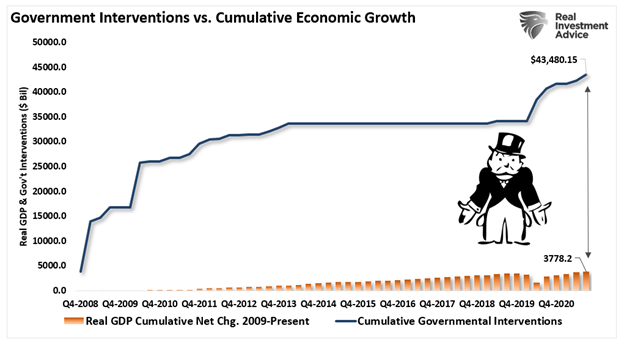

Such is why, after more than a decade of monetary and fiscal interventions totaling more than $43 Trillion and counting, the economy remains on ‘life support.’

(It required roughly $12 in support to generate $1 of economic growth.)

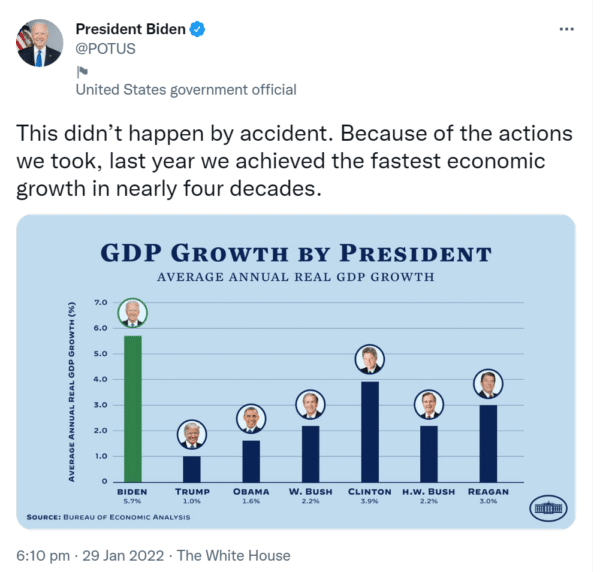

Nonetheless, President Biden recently took credit for the most significant surge in economic growth in decades.

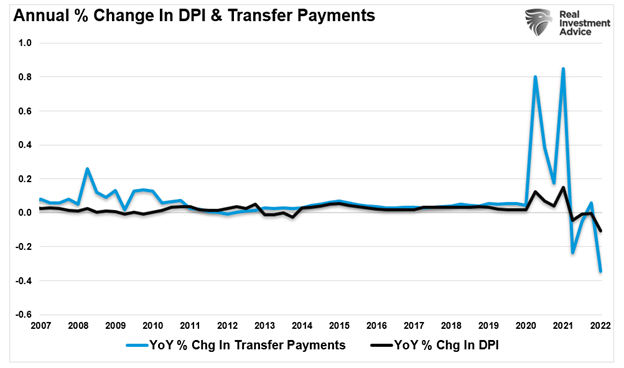

Of course, it doesn’t take much to realize that his claims of a robust economy relied heavily on the most significant surge in “social benefits” since the Great Depression.

Such was Goldman’s point as to the economic stagnation.

The Coming “Sugar Crash”

“As the stimulus hits consumers, they spend it rather quickly, which leads to a ‘sugar rush’ of economic activity. Such as:

- Consumers use the funds to make either necessary or discretionary purchases creating demand.

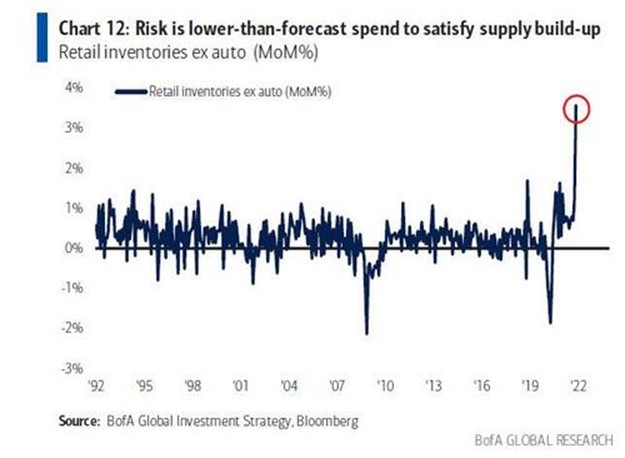

- In anticipation of demand, companies boost “inventories.”

- The boost in “inventory stocking” boosts manufacturing metrics.

Such is precisely what we saw, and now that cycle is beginning to reverse. As noted “Market Bottom:”

Stimulus payments to US households are evaporating from $2.8tn in 21 to $660bn, and there is no buffer from excess savings with the rate at 6.9%, which is lower than 7.7% in 2019). There is a huge inventory build in retail products (ex-auto), while the upcoming weak US consumption most likely catalyst for consensus cuts in GDP/EPS.”

Not surprisingly, the stimulus payments led to a short-term boost in PCE, corresponding with increased economic growth. (PCE comprises nearly 70% of the calculation.)

However, as noted in March 2020, stimulus-fueled activity has a “dark side.”

- Since companies know the stimulus is “temporary,” they don’t make long-term hiring and capital expenditure plans.

- The increase in activity leads to an inflationary rise that companies have difficulty passing on to consumers, ultimately reducing profit margins.

- Again, since companies know the stimulus is temporary, they opt for “efficiencies,” such as outsourcing and automation, to lower labor and production costs.

- After the stimulus gets depleted, consumers struggle with higher costs which further deteriorates their standard of living.

“Unless the Government is committed to a continuous stimulus, once the “sugar rush” fades, the economy will “crash” back to its organic state.” – Sugar Rush

Such is what will happen.

The Earnings Problem

When it comes to the stock market, the impact of economic stagnation is crucial.

One of the most fundamental disconnects currently is between stocks and the economy. Historically when stocks have deviated from the underlying economy, the eventual resolution is lower stock prices.

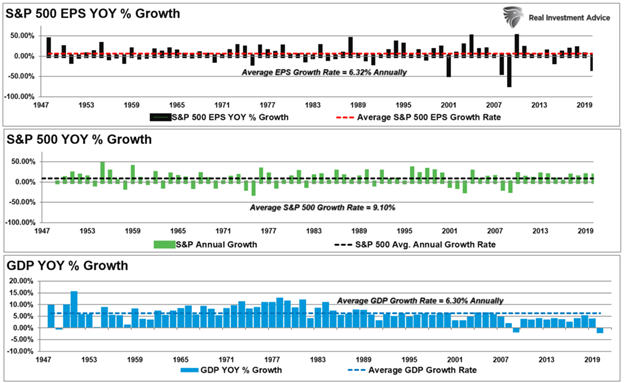

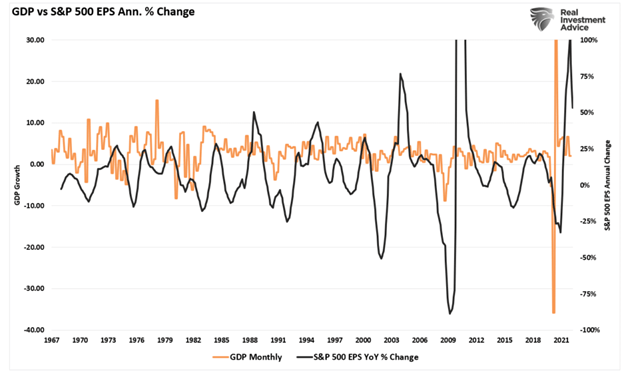

Over time, there is a close relationship between the economy, earnings, and asset prices. For example, the chart below compares the three from 1947 through 2020.

That close relationship in growth rates is logical given the significant role that consumer spending has in the GDP equation.

While stock prices can deviate from immediate activity, reversions to actual economic growth eventually occur. Such is because corporate earnings are a function of consumptive spending, corporate investments, imports, and exports.

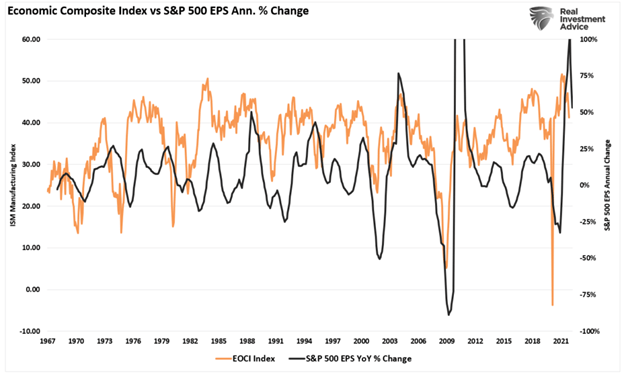

Our composite economic indicator closely tracks economic using more than 100 different data points. Not surprisingly, the surge in the composite from the 2020 lows has started to reverse along with earnings growth rates. As noted, the correlation between the economy and earnings should be no surprise.

We can see the same correlation between earnings and the annual rate of change in GDP.

What is clear is that the stimulus-fueled surge is now turning towards economic stagnation. That warrants some curbing of enthusiasm given the stock market’s history of sniffing out economic inflection points.

The reality is that the supports that drove the economic recovery will not support an ongoing economic expansion. One is self-sustaining organic growth from productive activity, and the other is not.

That market will figure that out.

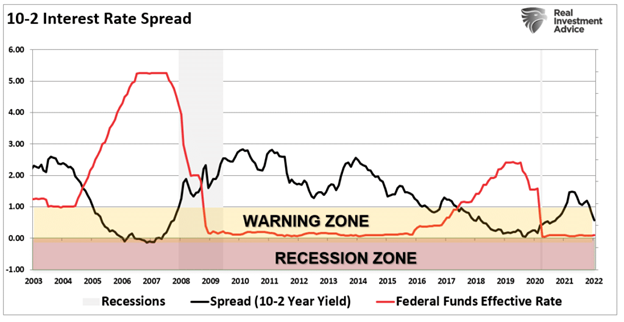

Watch The Yield Curve

If you want an answer for when economic deceleration becomes a problem, watch the yield curve. As I discussed in “3-Things, Will Tell You:”

“The yield curve is one of the most important indicators for determining when a recession, and a subsequent bear market, approaches.”

Of course, if the Fed begins to hike rates, with the yield curve already declining, an inversion is becoming an increasing possibility.

There is currently no indication of a recession. However, the “psychological Fed put” that supported markets and investor confidence is reversing. When the Fed previously started to hike rates, the clock started ticking towards the next recession and bear market.

As noted in Slowly At First:

“Understanding that change is occurring is what is essential. But, unfortunately, the reason investors ‘get trapped’ in bear markets is that when they realize what is happening, it is far too late to do anything about it.

Bull markets lure investors into believing ‘this time is different.’ When the topping process begins, that slow, arduous affair gets met with continued reasons why the ‘bull market will continue.’ The problem comes when it eventually doesn’t. As noted, ‘bear markets” are swift and brutal attacks on investor capital.'”

The “Sugar Rush” that drove economic acceleration, and fueled earnings growth, is now turning to economic deceleration. Such should not be a surprise, given simple math suggested this would be the case a year ago.

The only question now is whether the Fed will accelerate that economic deceleration into an economic recession.

The Fed’s track record of avoidance isn’t great.