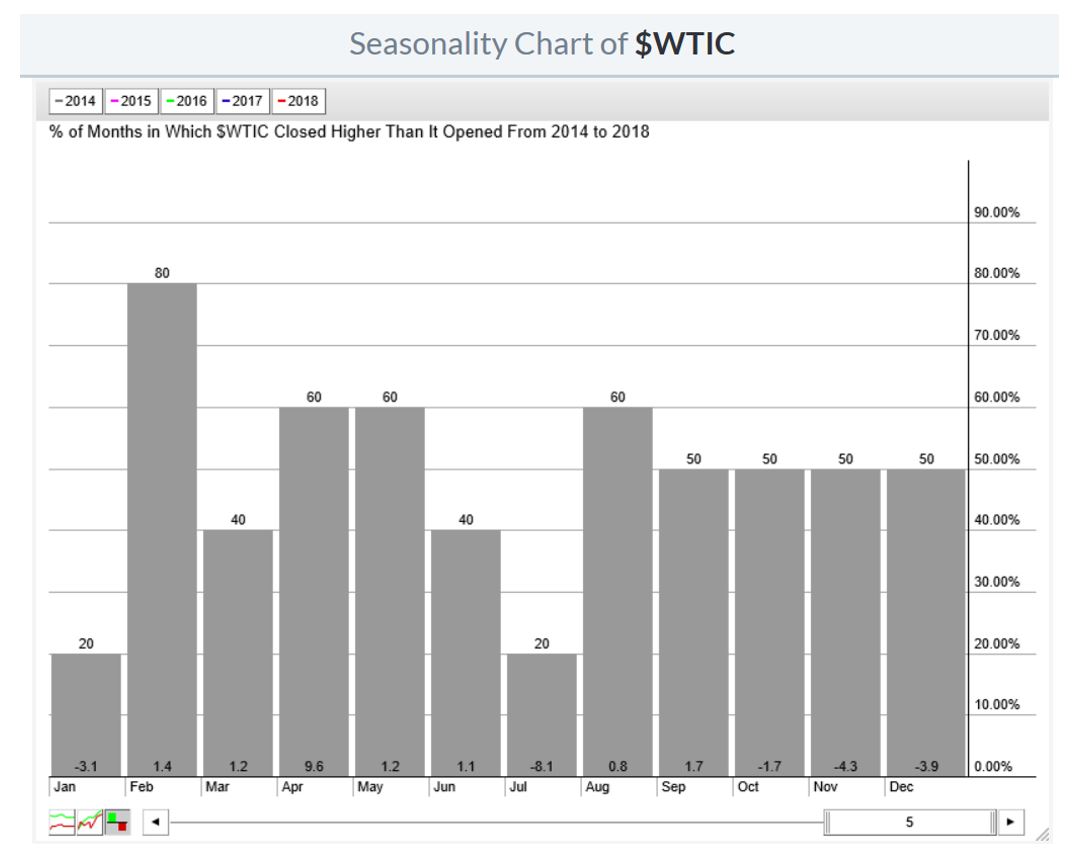

Crude has had quite the run lately. Through yesterday, it accomplished an 8.2% rise in 9 trading days. Technically, it now sits at its upper Bollinger Band and is at a resistance level. Technically, slow stochastics are in the overbought territory. Looking forward, Q4 prices are seasonally weak.

The last day of the month can see some price action as the Brent contract expires. Despite the current bullish candlesticks, charts are indicating headwinds if it wants to try to test the year’s high.

The post Crude – Time to Take a Breath? appeared first on Catalyst Hedged Commodity Strategy Fund Blog.