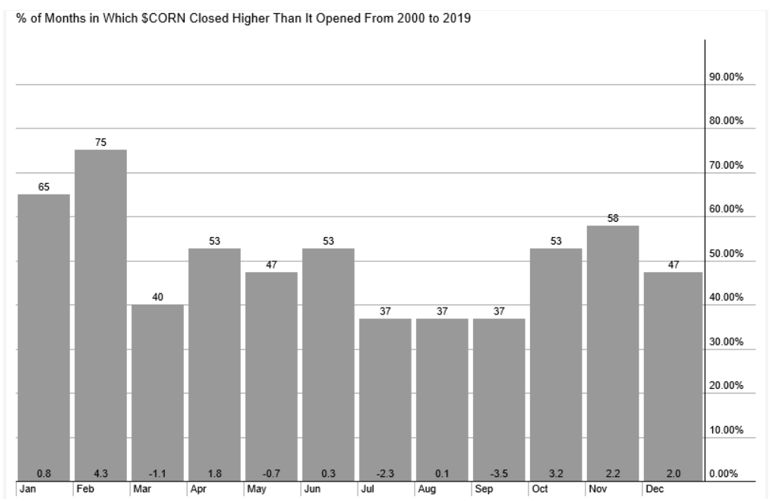

If you watch the corn market, you know it’s traded within a range since mid- September. Currently, the price of corn sits just 1% below where it started the year. Historically, some positive price movement has been seen early in the year, as the seasonal chart below indicates (Chart courtesy of Stockcharts.com).

With living in Wisconsin, it’s easy to look out the window and see the mass amounts of snow that accumulated during the winter. Logical reasoning is that a quick thaw can produce flooding and overflow rivers, if there is a great quantity of melt, especially in a short period of time. The news is starting to report flooding in Nebraska and Missouri, both corn-growing states. Northern WI still has a lot of snow that hasn’t melted. I’m wondering how Iowa and Illinois will fare once the northern snow melt gets into the rivers and heads south?

According to the USDA:

Corn is grown in most U.S. States, but production is concentrated in the Heartland region (including Illinois, Iowa, Indiana, eastern portions of South Dakota and Nebraska, western Kentucky and Ohio, and the northern two-thirds of Missouri). Iowa and Illinois, the top corn-producing States, typically account for about one-third of the U.S. crop. (https://www.ers.usda.gov/topics/crops/corn-and-other-feedgrains/feedgrains-sector-at-a-glance/)

Flooding can translate into planting fields late, or possibly not planting them at all. This should create some uncertainty on the supply-side, which can become a bullish story for the price of corn. This hasn’t happened as of yet. Corn is still trading sideways. Compared to last year’s 1st quarter, corn increased nearly 13% from the beginning of the year to its March 2018 peak, while this year has been nearly flat, trading close to its 50-day moving average.

News tends to focus around awaiting the trade deal and hard corn demand numbers. I’m hearing that funds are heavily short, and when I checked with our corn traders for what their sources are hearing, it seemed to be a consensus that the “issues” present should be bullish for price, however, it seems that system trading still shows negative momentum, therefore the shorts are still in play. I’ve also heard multiple traders speculate that if/when bullish news does appear, there is going to be a run to the upside while shorts are trying to cover.

As for now, patience may be the key for seasonal traders who side with being bullish for corn early in the year. Awaiting a clear technical breakout or a definitive agreement with China may be worth the wait.

The post Corn – Flooding Has Not Boosted Price Yet appeared first on Catalyst Hedged Commodity Strategy Fund Blog.