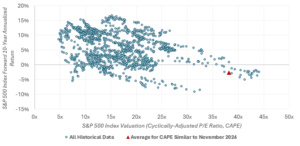

S&P 500 Cyclically Adjusted Price-to-Earnings Ratio (CAPE)

Even before November’s post-election rally, Wall Street was growing increasingly worried that the stock market was starting to get ahead of itself.

- In October, Goldman Sachs strategists cautioned investors to be prepared for stock market returns during the next decade that are toward the lower end of their typical performance distribution.

- As of November 11, 2024, the cyclically adjusted price-to-earnings ratio (or CAPE) hit a staggering 38.12x. Looking at these valuation levels going back to 1900, there has only been one instance where the S&P 500 produced a positive return in the following 10 years. In July 1998, the CAPE hit 38.26x and the 10-year return after was 0.84% annualized.

- S&P 500 10-year returns averaged -2.75% annualized following valuations like in November 2024.