Britain’s new prime minister, Boris Johnson, sports a mop of blond hair, shuns conventionality and routinely spins facts to suit his purpose. The photo is from a 2006 charity soccer game in London against Germany, when he head-speared an opponent in a maneuver better suited to wrestling. It’s an appropriate metaphor for the upcoming Brexit negotiations with the EU.

Even to a Brit, the unfolding constitutional drama has been hard to comprehend. Boris was chosen by 96,000 hard-core Conservative party members, and will be PM because they (barely) have a Parliamentary majority. The country voted for Brexit (by 52%-48%), and yet Parliament has rejected both a negotiated EU exit and a hard Brexit. It’s possible the next deadline of October 31 may pass with the UK still a reluctant EU member.

Poor leadership is all Britain has. If Theresa May wasn’t all but gone, she would have faced more withering criticism over the entanglement with Iran. Having seized an Iranian tanker, the careless loss of a British-flagged ship might charitably be ascribed to domestic leadership distractions. The inability of the Royal Navy to offer protection, along with Britain’s intimidating vow to resolve using all diplomatic means, reveals a country wrestling with diminished status and no plausible military option.

PM Johnson enters office with an unwanted foreign policy crisis. But as a vocal cheerleader for Brexit, it is appropriate that he should be the one leading the country as it plows ahead into unknown status.

Meanwhile, the main protagonists are both avoiding direct conflict — Iran because military defeat would be swift, and Trump because it would jeopardize his re-election. So the situation percolates without boiling over, with little end in sight.

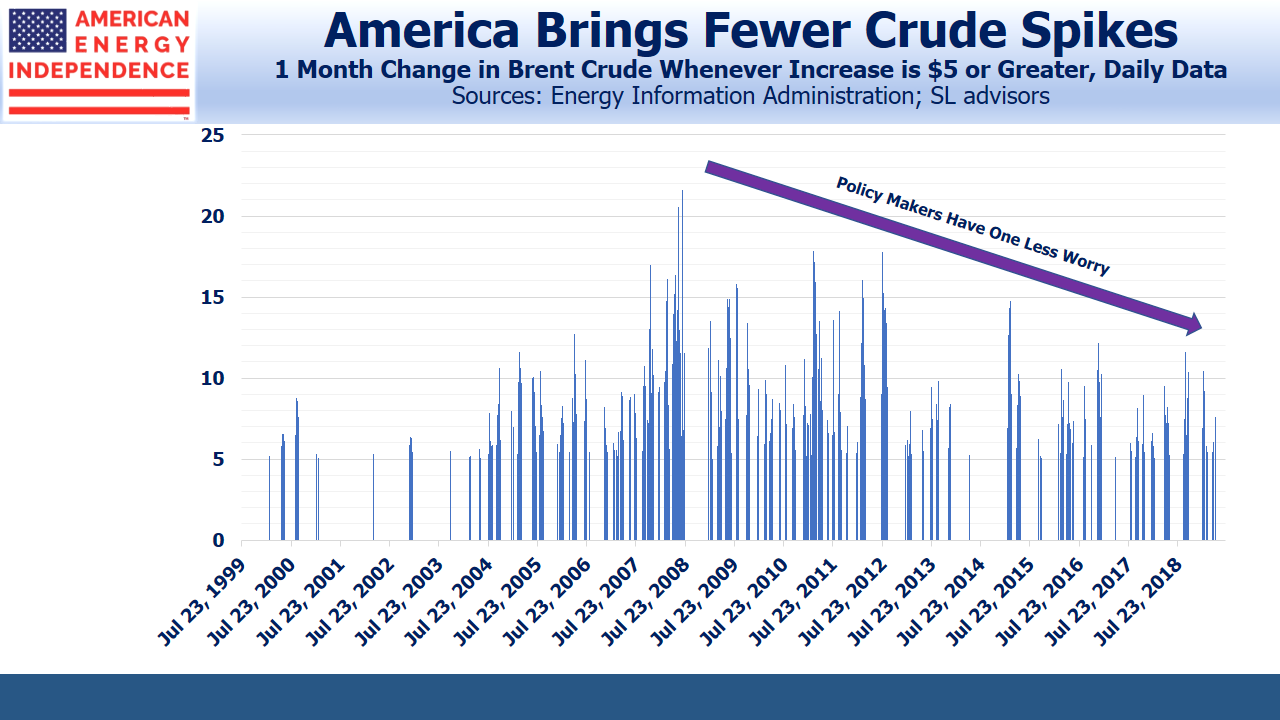

Crude traders have remained sanguine over the potential for supply disruption through the Straits of Hormuz. A defining feature of the Shale Revolution is that it has ameliorated the price spikes that used to threaten global growth. Higher prices increase profitably accessible reserves, and shale’s short production cycle always promises more availability within a matter of months, if needed.

Britain’s economy is slowing due to Brexit uncertainty. Shaky consumer confidence doesn’t need a debilitating spike in crude. Fortunately, such moves are becoming rarer. Volatility in crude oil isn’t much different than a decade ago, because prices still fall quickly. But world growth is more susceptible to sharp increases. Encouragingly, price spikes are becoming less frequent and milder, another tangible demonstration of the Shale Revolution’s impact in addition to generally lower prices.

President Trump could justifiably note how American energy independence is protecting oil importing nations like Britain from price shocks. PM Johnson needs a narrowing Atlantic to offset the politically widening English Channel.

U.S. LNG exports, another Shale Revolution benefit, are likely to be on the table as Brexit Britain seeks deeper ties with the U.S., allowing Trump to show he can close a trade deal. A Donald-Boris honeymoon beckons.

The post Brexit Meets the Shale Revolution appeared first on SL-Advisors.