Right up until the last minute, environmental extremists continued to use the court system to stymie completion of the Mountain Valley Pipeline (MVP), which will move natural gas from West Virginia to Virginia. Permits have been issued by too many Federal and state agencies to list here. Extremists led by the Sierra Club with their agenda of limiting energy access continued their relentless abuse of the courts seeking the overturn of previously issued permits.

On Friday, the US Court of Appeals for the District of Columbia agreed that the Federal Energy Regulatory Commission (FERC) had “inadequately explained its decision not to prepare a supplemental environmental impact statement.”

This is how infrastructure projects get held up. The US judicial system is ponderous and unpredictable, which can shred IRR estimates. It’s why nuclear power plants don’t get built. And the same technique is already impacting the build out of renewables. Nobody wants transmission cables built near them.

Equitrans, the main owner of MVP, has struggled for years to overcome legal obstacles and complete the remaining few miles of the pipeline so it can be put into service. A 98% completed pipeline doesn’t generate cashflow. Senator Joe Manchin (D-WVa) thought he had an agreement to pass permitting reform that would have ended the legal challenges to MVP when he threw his support behind the Inflation Reduction Act (IRA). But the expected new legislation never came, as support from both parties melted away.

West Virginia is coal country, and Manchin’s support of the IRA, which includes features intended to drive coal consumption down, has made him one of America’s least popular senators. He’s running for re-election next year and has said he’d vote to repeal the IRA if given the opportunity. Manchin’s Republican opponent Governor Jim Justice has a higher approval rating than Manchin in the state even among Democrats.

Improbably, the debt ceiling legislation is being used to help Joe Manchin’s re-election prospects because a policy rider attached to it supercedes existing legal challenges. The draft legislation includes the following language:

Congress (1) ratifies and approves all permits for construction and initial operation at full capacity of MVP through Secretary of the Army, FERC, Secretary of Agriculture and Secretary of Interior (together, the “Federal Agencies”), (2) gives 21 days from enactment for the Secretary of the Army to give permits for MVP to cross waters and operate, (3) provides judicial review whereby no court has jurisdiction to review any action by the Federal Agencies, including any pending lawsuits (importantly removing the overhang from 4th Circuit, which vacated the WV water permit), and (4) directs any claim against the validity of this law to the DC District US Court of Appeals.

In other words, Congress makes completion of MVP a matter of law, greatly reducing although not eliminating the power of the courts to continue blocking it. That a virtually completed pipeline still requires specific congressional legislation to cross the finish line shows how broken is our country’s permitting of new infrastructure. Climate extremists won’t be happy with MVP, but deployment of renewables infrastructure is at least as vulnerable to similar abusive tactics of the court system.

Equitrans (ETRN) stock jumped yesterday on the news. We had felt its prior valuation assumed MVP would never go into service, so it offered a free call option on its completion. NextEra, a partner in the project, wrote their interest down to zero last year (see High-Energy Earnings Boost Pipelines).

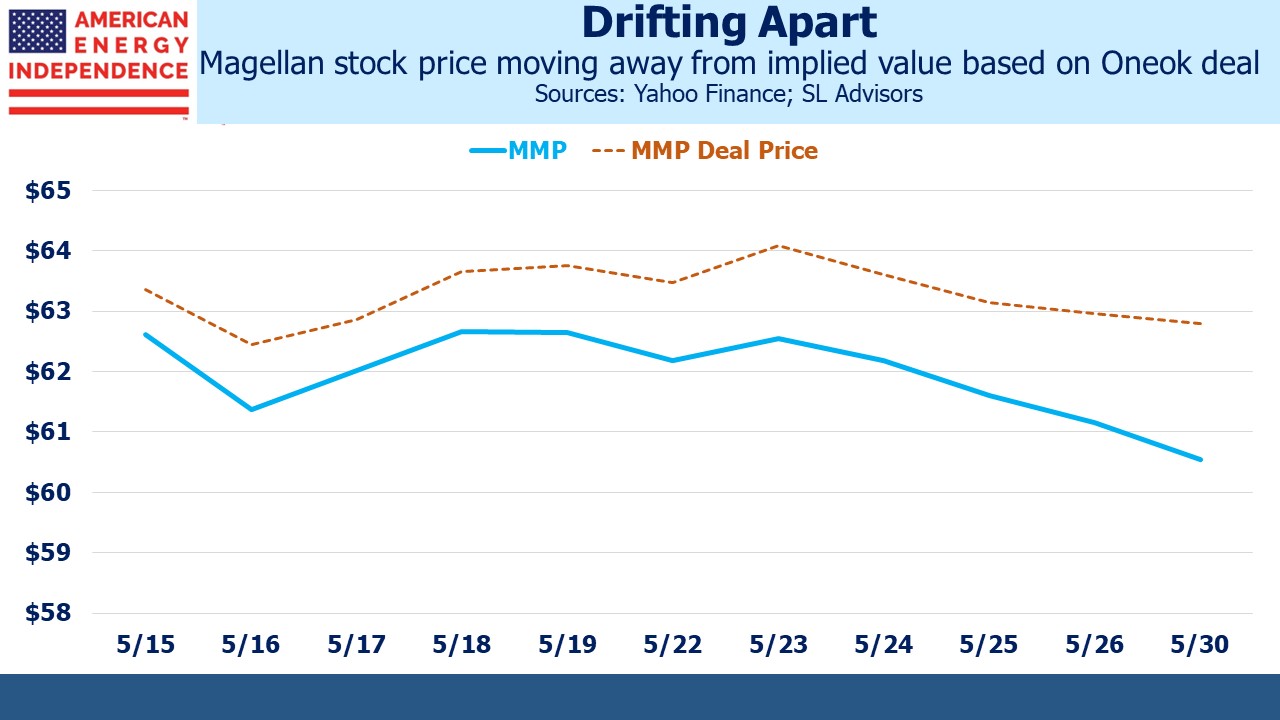

Oneok’s (OKE) proposed acquisition of Magellan Midstream (MMP) is quietly losing support. As we’ve noted (see Oneok Does A Deal Nobody Needs) many MMP investors will face a bill for the recapture of deferred taxes. Advisors who own MMP in separately managed accounts will need to explain this to every client, and since deferral of taxes is often the point of owning MLPs, this isn’t a conversation they’ll approach enthusiastically.

OKE’s stock has sunk 10% since the deal was announced, so their investors are less enamored of the promised $1.5BN tax shield (obtained at the expense of MMP unitholders) than they are dismayed at the jump in leverage to 4.0X to finance the deal.

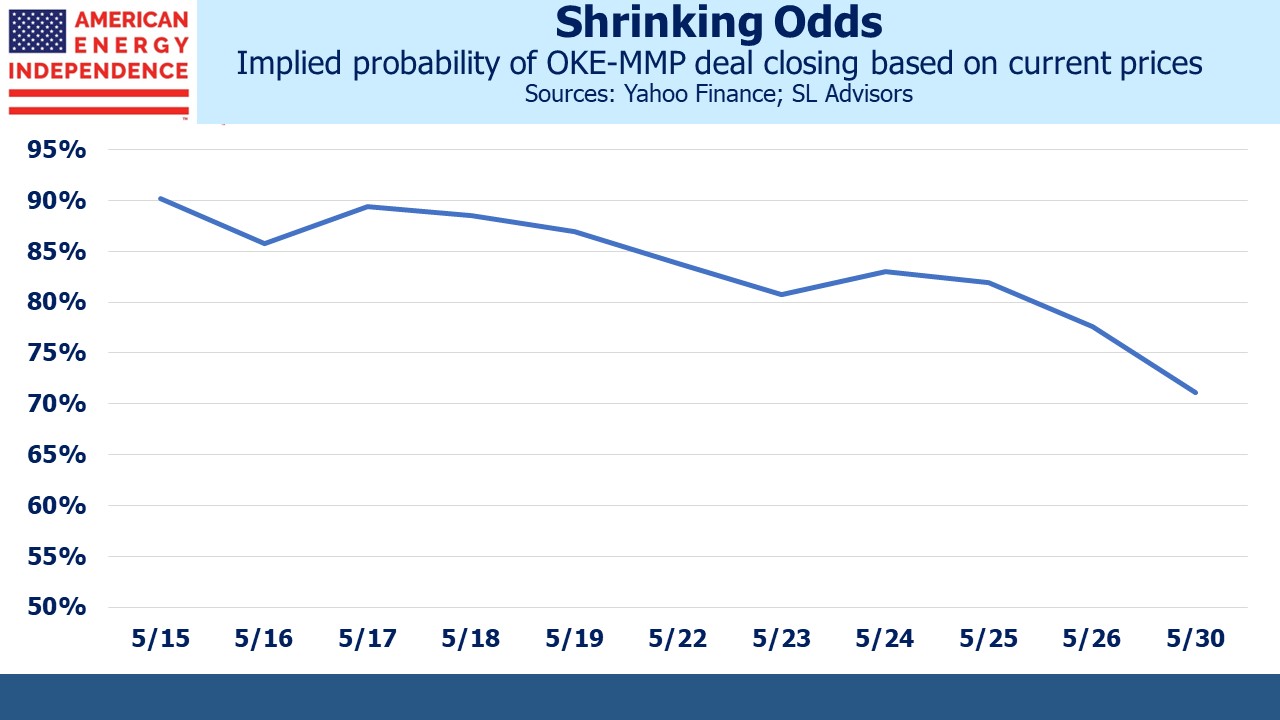

There are plenty of stakeholders who could find it in their interests to vote no. We calculate the odds of it going through have slipped noticeably, although still more likely than not. Both management teams face an uphill battle persuading investors to approve the deal. As we’ve mentioned before, as owners of equity in both OKE and MMP we’re going to use both opportunities to vote no. We would have preferred to see MMP combine with another MLP, which could have avoided the deferred tax recapture.

MLPs were also noticeably weaker than c-corps yesterday, unwinding some of the boost the smaller ones had received in anticipation of Alerian having to rebalance its index (see Alerian Still Clinging On). This confirms the market’s revised assessment of the probability of the deal closing.

The post A Pipeline Win From The Debt Ceiling appeared first on SL-Advisors.