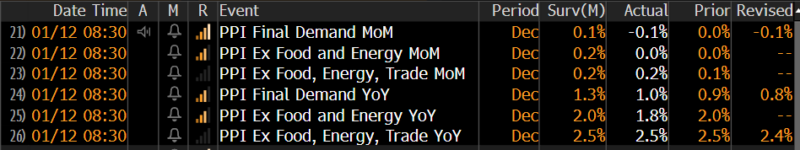

January 12, 2024 – Today’s Producer Price Index report supports the notion that inflation has essentially been defeated. PPI fell to negative headline MoM, 0% core MoM, 1.8% YoY core change, and 1.0% YoY headline change.

The PPI feeds into PCE, which is the Fed’s preferred inflation gauge, which has already been running below 2% on a 6-month annualized basis. Today’s data suggest PCE will fall further, potentially solidifying a March rate cut.

Yesterday’s CPI report was a bit misleading, still showing a 0.5% increase in shelter related costs (rent and owner equivalent rent). As we have written about for months, this requires looking through. All leading rent indices reflect rents coming down across the country; it will eventually show up in the highly lagged BLS calculation that goes into CPI.

The rate curve is steepening, with the 2-year now down over 10 bps below 4.15% (as of 9:35 a.m.). If it closes here today below resistance, the next stop is roughly 3.95%, which would place the 2-year note approximately 155 bps inverted to Fed Funds (5.25 – 5.50%), ringing alarm bells for imminent Fed cuts.

Source: Bloomberg.