Concentration of Gains

Investment advisors face challenges in managing portfolios amidst a dynamic market. One notable trend is the flat performance of Russell 1000 value, coupled with suppressed volatility in a range-bound market. Concerns arise from the concentration of gains within a few names, particularly in the tech sector, within the S&P 500. This concentration raises concerns about the valuation of the largest tech companies. In this blog post, we will explore strategies and options to mitigate risks and seize opportunities in this scenario.

Understanding the Current Market Dynamics:

The performance of the Russell 1000 value index has shown limited progress this year, posing challenges for value investors. Additionally, volatility levels have been subdued, typical of range-bound markets. Despite overall gains in the S&P 500, it is essential to acknowledge that these gains stem mainly from a small group of companies. As an investment advisor focusing on portfolio allocation, this concentration of gains makes it difficult to find refuge, particularly when relying solely on the S&P 500. Such limited market breadth historically indicates a weaker economic outlook, further complicating investment decisions for value-oriented investors.

The Role of Volatility as a Hedge:

Volatility, typically viewed as a hedge against market fluctuations, becomes even more appealing when volatility levels are low. While the overall market volatility remains suppressed, investment advisors must consider incorporating volatility hedging strategies to protect against potential downside risks. One such option is a volatility-hedged equity strategy, which can potentially offer exposure to value even during a recession or when interest rates rise.

Leveraging a Nasdaq-100 Hedged Equity Strategy:

Adding a hedge may help investors address concerns about the valuation-heavy tech sector. Given the potential for the ongoing AI revolution, owning tech stocks could be a prudent decision, and a Nasdaq-100 Hedged Equity Strategy presents an opportunity to do so with a risk management strategy in place.

Anticipating Recession and Market Movements:

While recession concerns loom, it is essential to navigate the market accordingly. A contrarian approach to volatility can be beneficial. Historically, when volatility is high, it tends to decrease, and when it is low, it often rises. As all eyes are currently on the debt ceiling fight, it is noteworthy that volatility levels remain similar to those observed in 2021. However, as the deadline approaches and uncertainty prevails, we can anticipate a rise in volatility before it eventually subsides once a deal is finalized.

The Importance of Monitoring Unemployment:

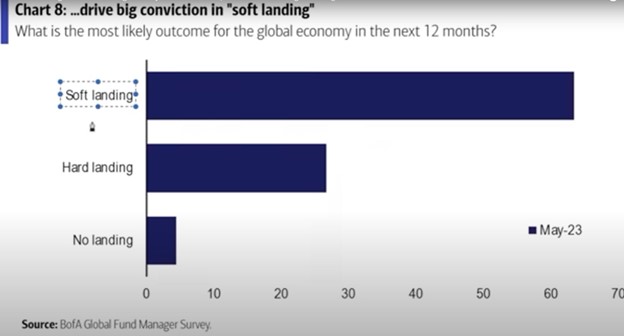

As investment advisors assess market conditions, one crucial factor to monitor is the unemployment situation. Presently, equities seem to be pricing in a soft landing or no recession. However, rising unemployment claims, currently at their highest levels since 2021, serve as a leading indicator of potential job losses. Keeping a close eye on the jobs market can provide valuable insights into whether a hard landing is imminent.

Conclusion

In the ever-evolving landscape of portfolio allocation, investment advisors face unique challenges. The current market scenario, with the flat performance of Russell 1000 value and suppressed volatility in a range-bound market, demands a careful approach. By considering volatility as a hedge, exploring strategies like a volatility-hedged equity strategy and a Nasdaq-100 hedged equity strategy, and monitoring indicators such as the debt ceiling and unemployment, investment advisors can make informed decisions to navigate potential risks and seize opportunities. Remember, a proactive and contrarian approach to market volatility can be advantageous in the pursuit of long-term investment success.