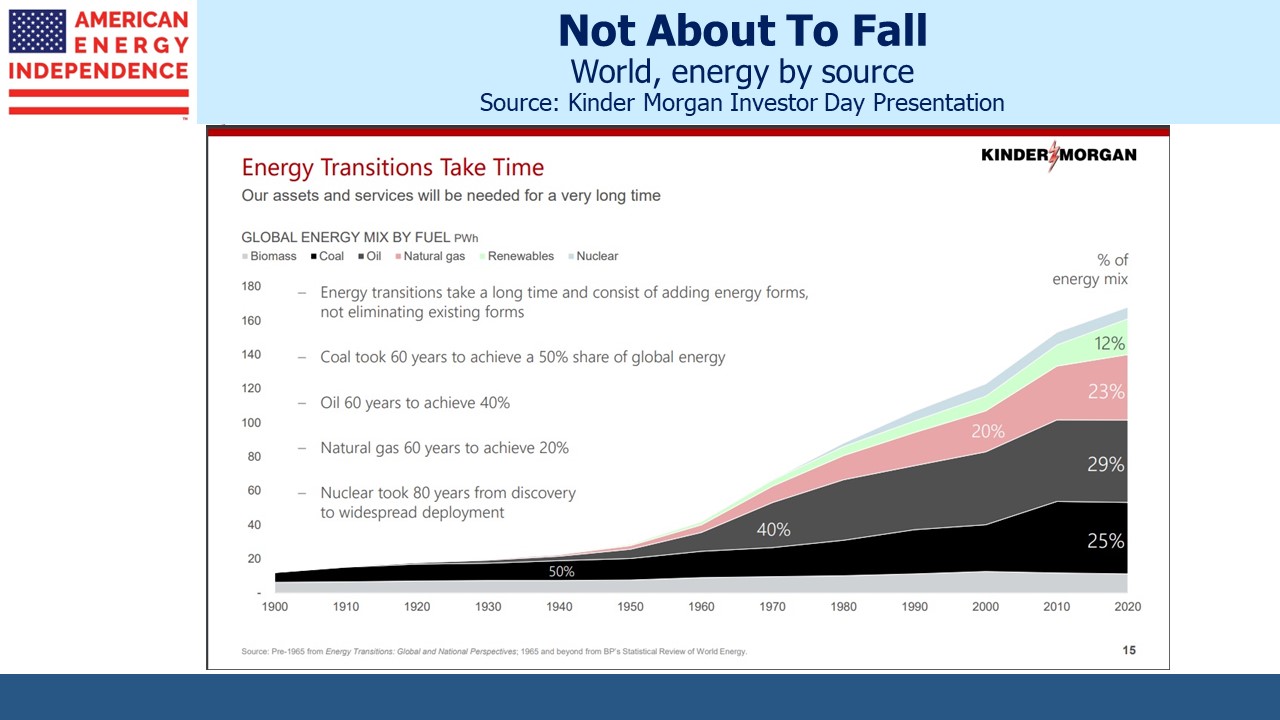

The BP Statistical Review of World Energy used to be a fact-based compilation of useful data. Skimming through the 2016 version, it recounts what happened and comments on likely trends. In recent years it has unfortunately degenerated into a political document. The historic data remains useful, but its implausible forecasts are there to defend itself against woke climate cops accusing it of burning up the planet.

BP can point to its Net Zero and Accelerated scenarios which show global CO2 emissions immediately declining from 40 Gigatonnes (GT) to reach 9 and 4 GTs respectively by 2050. This shows they’re on board with global energy consumption dropping by a third or a fifth, at odds with over a hundred years of history. The emerging world’s insatiable desire to raise living standards and energy use will somehow be ameliorated by a dramatic increase in efficiency improvements. Nobody who has studied the issue takes this seriously.

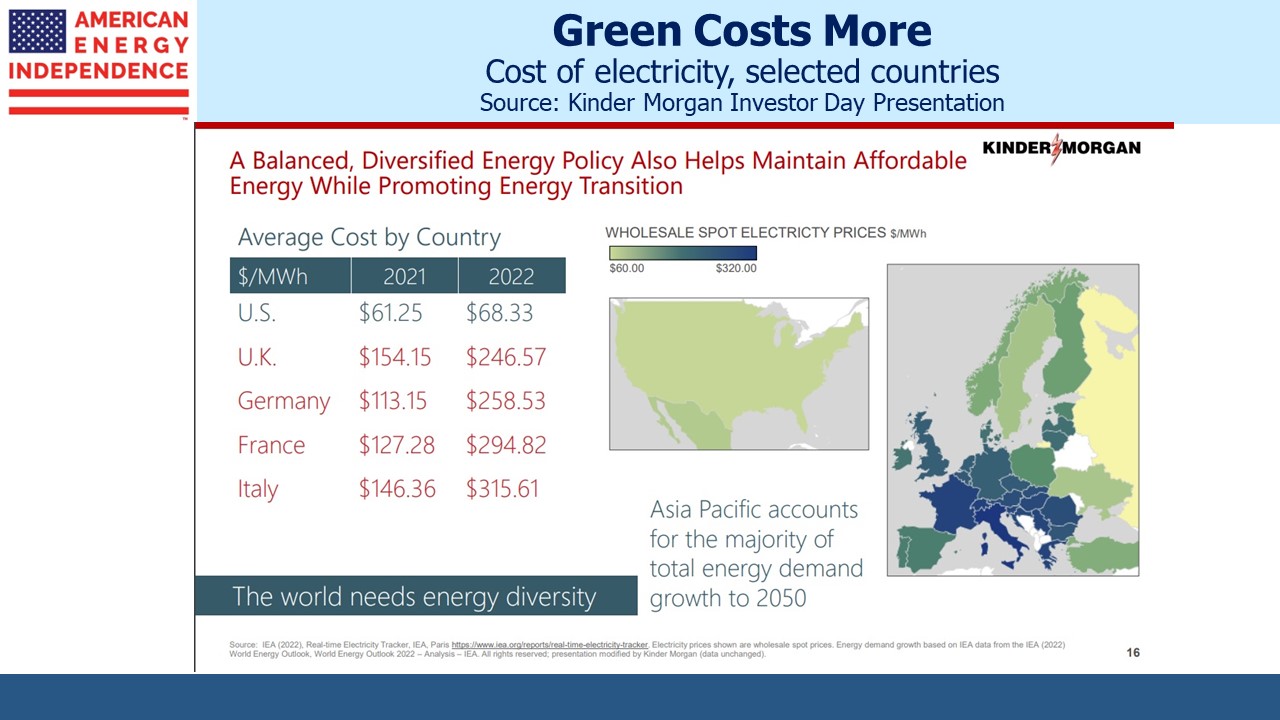

If you accept that solar and wind are better for the environment, they are certainly not more efficient. They are much less energy dense which means they require more land. Long distance transmission lines move power from lightly populated areas where it’s produced to cities where it’s needed. Batteries or natural gas power plants provide back up for weather-induced intermittency. More renewables means higher energy costs, possibly a price worth paying, and a choice made most clearly in western Europe.

BP can wave this document at the climate extremists who reject everything but solar and wind, to show that they are directionally aligned if not yet in the same place. Net Zero and Accelerated are climate sound bites.

But the executive summary then adds, “These scenarios are not predictions of what is likely to happen or what BP would like to happen.”

BP neither wants nor expects Net Zero or Accelerated? So why include them? It’s how big energy companies deflect their left-wing critics while delivering the energy the world needs in the form it wants, at considerable profit last year. What BP puts in its energy outlook doesn’t reflect its assumptions when investing capital, allowing them to act differently than they speak.

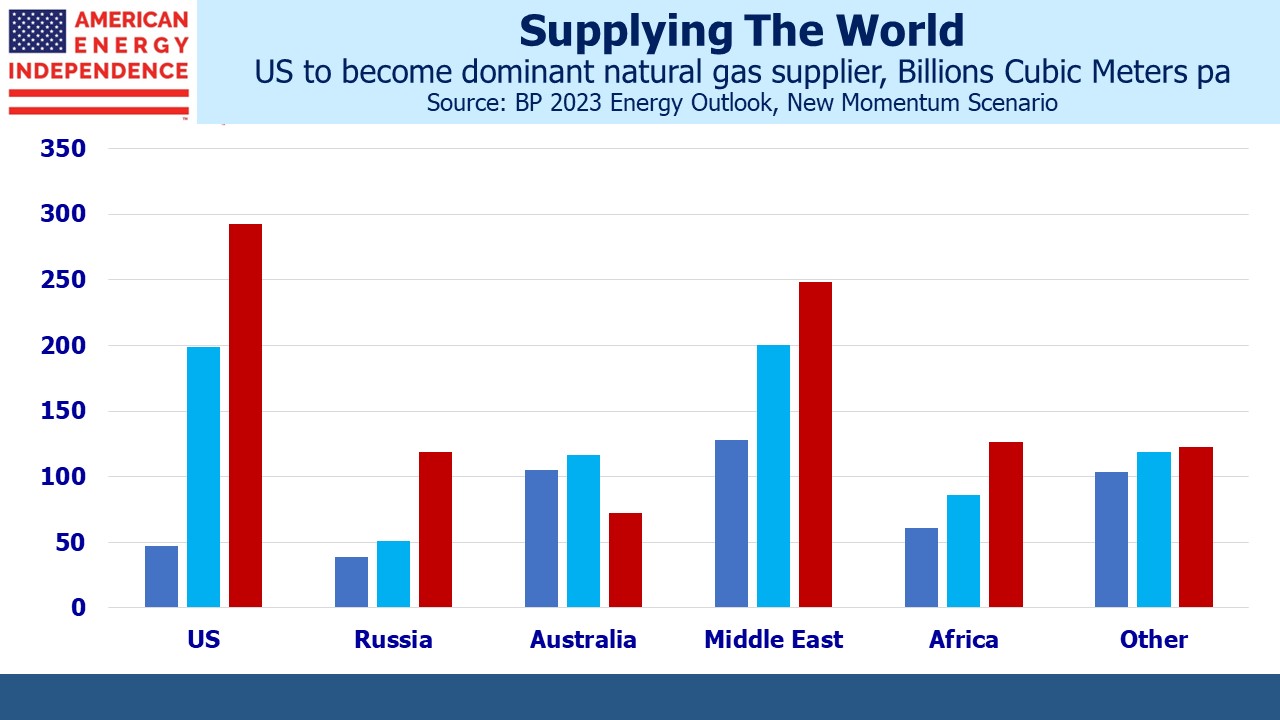

New Momentum, the third and only realistic scenario BP offers, is based on current trends and plausible policies. It’s the only one worth considering.

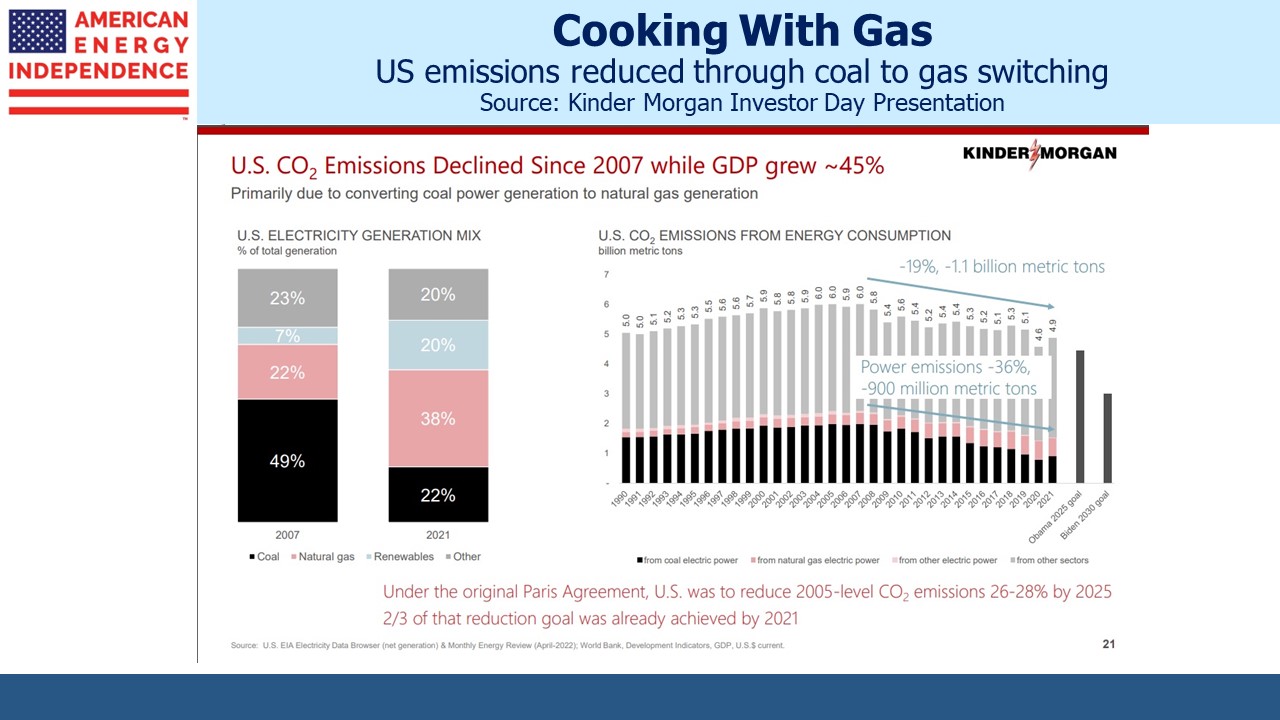

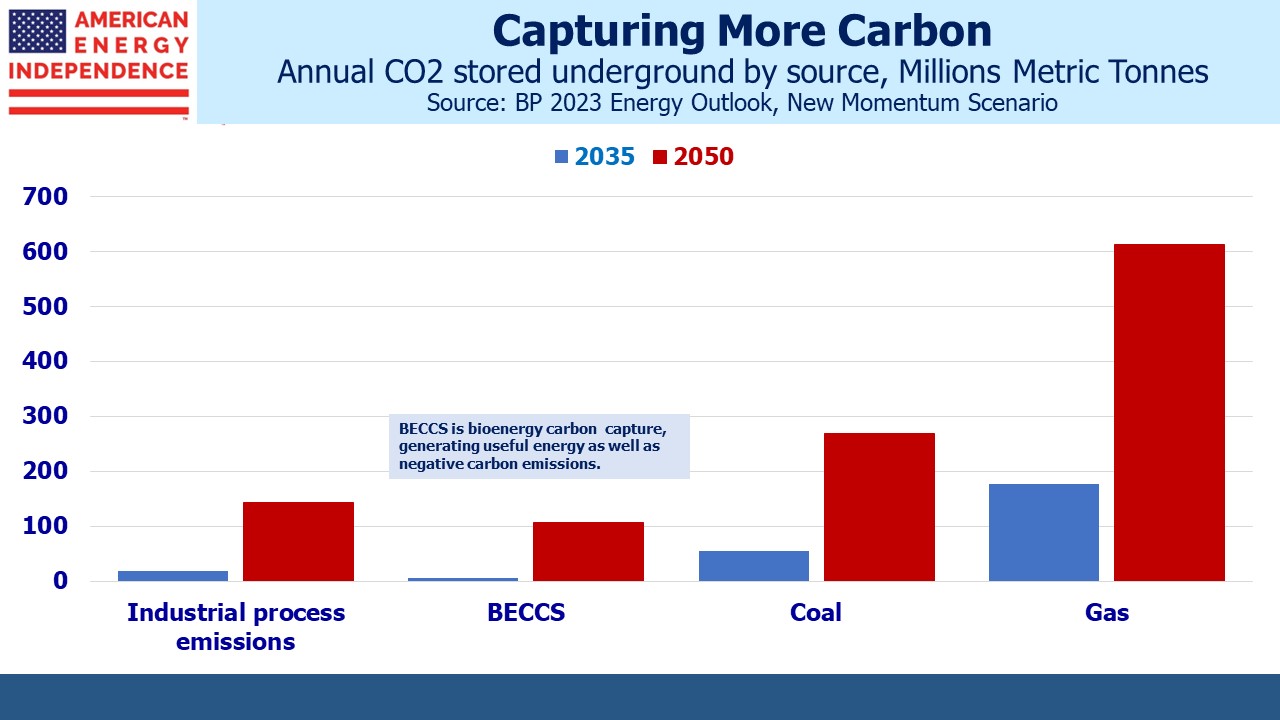

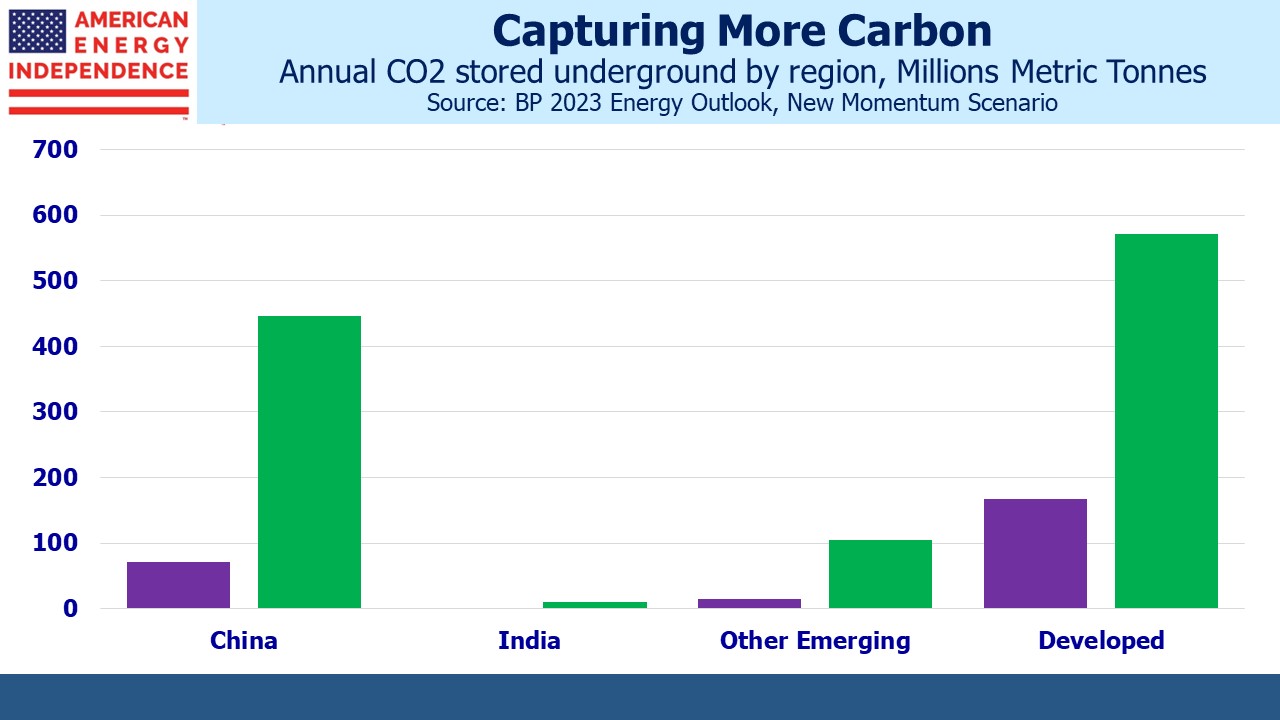

We think the world will reduce greenhouse gas emissions with cleaner energy (coal to gas switching), increased use of other forms of reliable energy (nuclear; hydrogen), carbon capture and new technologies such as additives for cattle feed (see How Seaweed Can Fight Global Warming).

Solar and wind will assuredly grow but don’t offer the reliable long term cash flows available in infrastructure. The reality of investment results caused BP to slow its planned reduction in fossil fuel production from 40% to 25% by 2030 amid disappointing returns on renewables. Shell plans to keep renewables at about 14% of capex, flat with last year.

Duke Energy is taking a $1.3BN impairment loss on the sale of its renewables business. Dominion Energy recorded a $1.5BN impairment on its unregulated solar business. Exxon has slashed funding for Viridos Inc, a company in La Jolla, CA that makes environmentally friendly fuels from algae. This initiative was once among Exxon’s highest profile in its Low Carbon Solutions unit. They now see better opportunities in carbon capture and hydrogen.

The outlook for practical climate change solutions is improving. Growth in natural gas trade will temper coal consumption and offers the world’s best chance to reduce emissions if emerging countries follow what the US has done. The Inflation Reduction Act increased the tax credits for carbon capture. This is causing much greater take-up than the Congressional Budget Office (CBO) forecast, so Credit Suisse believes the $3BN ten year cost the CBO originally forecast is likely to be over $50BN (see US Oil And Gas Production Growing).

Enbridge has 10-15 hydrogen projects underway in Ontario and Quebec. They’re developing a hydrogen and ammonia production/export facility near Corpus Christi, TX. Converting renewable energy into clean-burning liquids that can be transported via pipeline or ship to power plants seems more viable than a grid that’s overly dependent on sunny and windy weather. It pushes the intermittency problem back to a production facility, doesn’t rely on batteries or require extensive new transmission lines.

Midstream is transitioning beyond fossil fuel infrastructure to play a critical role in reducing emissions. The fear of stranded assets is receding in favor of repurposed assets that gain a longer useful life and a higher net present value.

The post The Pragmatic Energy Transition appeared first on SL-Advisors.