The energy sector, already responding to inflation in recent months, has been a clear winner from Russia’s invasion of Ukraine. Few countries in history have striven for energy independence as much as America. Having achieved it, the US is now in a position to help Europeans achieve energy security. They have no hope of energy independence, but can at least achieve more diversity of supply.

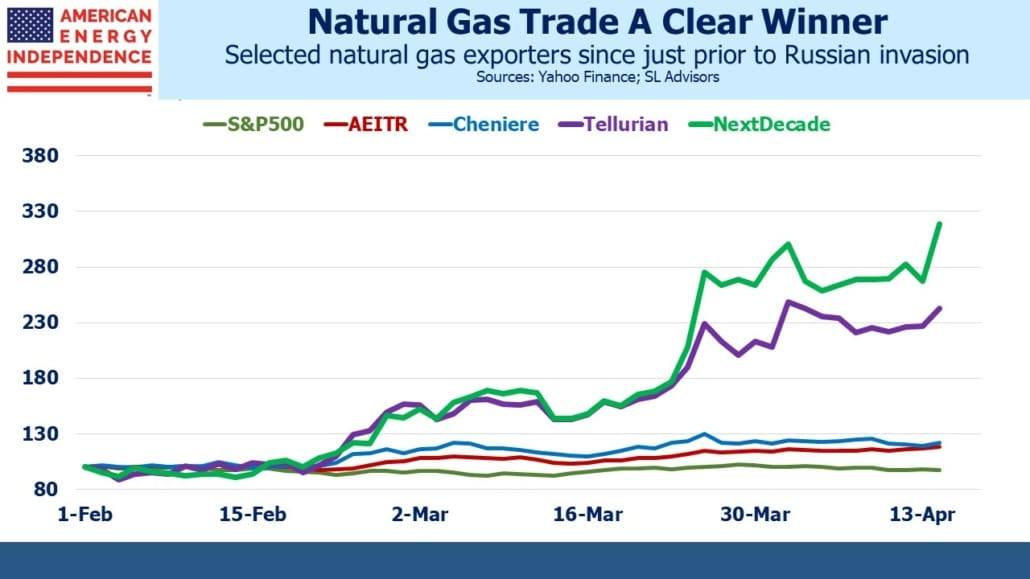

Within the energy sector, natural gas has been a winner and companies involved in exporting Liquefied Natural Gas (LNG) have soared. Tellurian (TELL) and NextDecade (NEXT) both plan to export LNG from facilities that are not yet built. Their odds of acquiring the customers and capital to fulfill their goals meaningfully improved once the EU acknowledged the catastrophe that was its prior energy policy.

It’s rare to see political leaders abruptly forced to pivot. UK PM Chamberlain’s late 1930s appeasement of Hitler was one. It would have been more appropriate if former German chancellor Merkel was still in power so she could publicly abandon the now discredited policy of “Wandel durch Handel” – change through trade.

NEXT’s Carbon Solutions division was created as a result of French utility Engie ending LNG discussions in 2019 because of concerns about US flaring. European customers were expected to be the target market for a new offering which captures the CO2 from natural gas processing and liquefaction – especially so now they’re scrambling to find alternatives to Russian supply.

But Asian buyers are moving more quickly. NEXT has recently signed two such deals each worth 1.5 million tons per annum. Meanwhile TELL has begun construction of their Driftwood LNG facility without yet having firm financing lined up – no doubt to demonstrate their confidence that the capital will be available. Of the two, we prefer NEXT. Its business model avoids exposure to natural gas prices, contrasting with TELL which retains some of that risk because they’re bullish on prices. TELL CEO Charif Souki has a healthy risk appetite – two years ago the sector’s collapse led to him being forced to liquidate personal holdings of TELL because of a margin call. The company issued him more shares anyway.

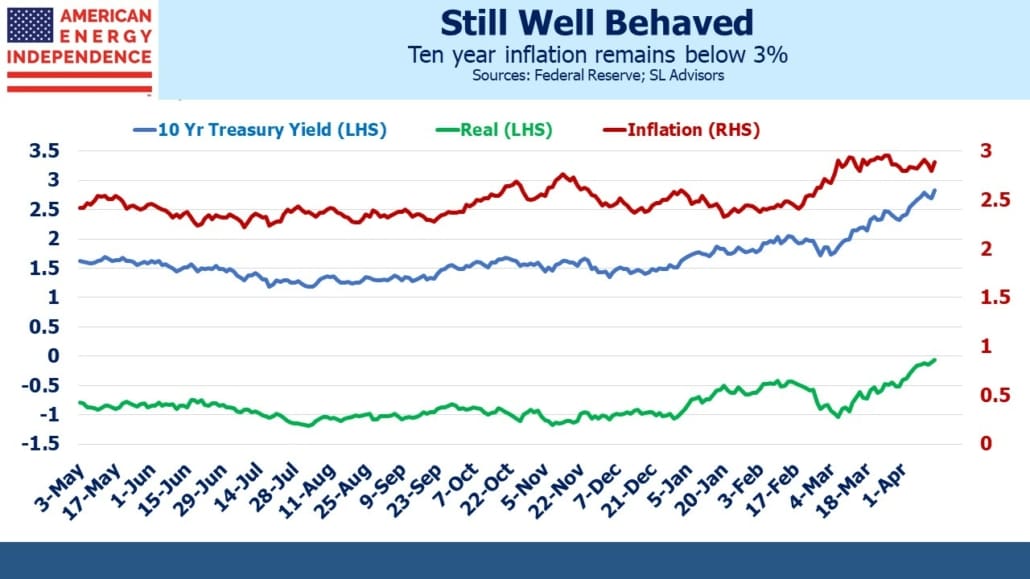

Revamped European energy policy has provided support for the energy sector at a time when inflation expectations have remained surprisingly well constrained. Ten year inflation as derived from the treasury market moved from 2.5% to just below 3% by early March but has remained there ever since. Real yields have been moving higher – meaning they are less negative – as the market has begun to price in Quantitative Tightening (QT).

It seems inevitable that the opposite of Quantitative Easing (QE) will be needed when the Fed is trying to achieve the opposite result. The spread between two and ten year treasury yields had briefly gone negative, causing some commentators to warn of an impending recession. Discussion in the Fed’s minutes about the need to shrink the balance sheet helped reverse this.

QE reflected the Fed’s recognition that long term rates matter more than the Fed Funds rate. Bill Dudley, former NY Fed president, has noted that the continued relatively low ten year yield means the Fed hasn’t yet achieved much in terms of imposing more restrictive financial conditions. St. Louis Fed president James Bullard worries that they are behind the curve (which hardly needs saying) and suggested a 3.5% Funds rate might be needed.

It really depends on what it takes to get ten year yields higher. This is the first meaningful tightening cycle since Ben Bernanke conceived QE in 2008. Expect more discussion in minutes and elsewhere about what the Fed can do to push up long term rates. It’s a task made more difficult by negative real yields – a persistent gift from return-insensitive investors to America, that nonetheless mutes the transmission mechanism from the Fed Funds rate to bond yields.

If the Fed opts to shrink their balance sheet more aggressively, by for example auctioning off some of their holdings of mortgage backed securities, the resulting increase in bond yields would mitigate some of the need to drive up short term rates.

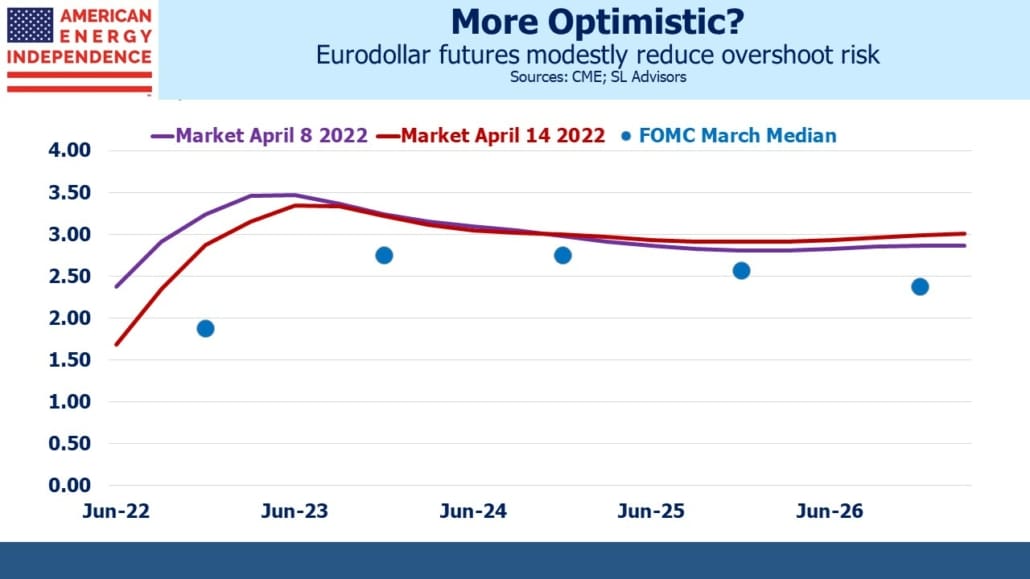

Hence the eurodollar futures curve lost some of its inversion recently. It’s still priced for the Fed to finish tightening by the end of next year and then begin lowering rates in 2024. Given this Fed’s reinterpreted dual mandate, it’s likely they’ll be acutely sensitive to the possibility of a recession. Since QT has never been done, it promises to be a learning experience for everyone.

We have three funds that seek to profit from this environment:

Energy Mutual Fund

Energy ETF

Inflation Fund

Please see important Legal Disclosures.

The post LNG Stocks And Real Yields Rise appeared first on SL-Advisors.