For the past few months the eurodollar futures market has steadily priced in the FOMC’s abandonment of “transitory” in its assessment of inflation. More often than not the Fed follows the market. The typical absence of public comments that precedes FOMC meetings was extended while Biden contemplated renewing Powell’s term. In short order, Powell’s reappointment was announced, several Fed governors publicly contemplated faster tapering and the release of minutes revealed a lively debate. “Transitory” has become a derogatory adjective in finance betraying cognitive dissonance. As in, “The hedge fund manager described his losses from shorting meme stocks as transitory.” Something is transitory, until its permanence becomes painfully obvious.

President Biden and Fed chair Powell had their discussion during which no doubt Biden hoped for a lethargic policy response to inflation while Powell demurred. With Powell’s reappointment secure, all that was left was for the next FOMC meeting to make the taper briefer, in preparation for three to four rate hikes beginning next spring.

B.1.1.529, the new Covid mutation identified in South Africa, has scrambled everything. The World Health Organization has assigned it the Greek letter “Omicron” since that’s the next one in the alphabet. The $8 drop in crude oil will be welcomed by the Administration which will likely claim partial credit since it so closely followed the release from the Strategic Petroleum Reserve. Eurodollar futures removed one projected tightening from next year.

The energy sector modestly outpaced the S&P 500’s 2.2% fall, dropping 2.6% (defined as the American Energy Independence Index).

Last year when investors asked for our outlook on midstream energy infrastructure, we’d often note that the path of Covid would be an important factor. We all became amateur virologists in attempting to project investment returns. The vaccine ushered in economic growth powered by an excessive fiscal response, with the removal of monetary accommodation (albeit very late).

How much has changed?

As before, the near-term direction depends on the virus. If existing vaccines prove ineffective, economic activity will slow until a new one is created and distributed. Some fear the new mutation may require a new vaccine. It’s a science question not an economic one.

The pipeline sector has just reported solid 3Q21 earnings. Cash flows continue to grow, buoyed by recovering volumes and continued financial discipline. Progressive energy policies have been more constructive than expected – impeding sufficient supply of oil and natural gas has improved prices and sentiment. COP26 revealed the gulf that exists between the climate goals of OECD countries and the growth objectives of emerging countries. Unilateral policies to accelerate the energy transition increase prices for consumers and mostly serve to accommodate increased emissions from China, India and others.

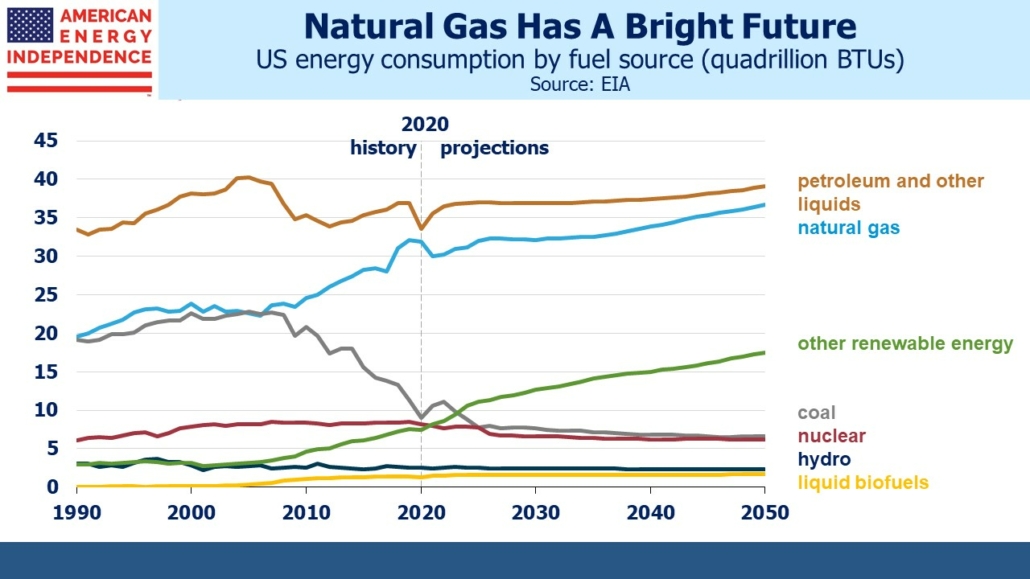

Given the uncertain near-term direction, it can be helpful to remember the long-term growth outlook for US energy consumption. Although renewables command excessive media attention, the chart shows that the big energy story of the past decade was the huge drop in coal consumption which was mostly offset by increased natural gas.

The Energy Information Administration expects the US to increase consumption of renewables, natural gas and even petroleum products over the next three decades. “Other renewables”, which is mostly solar and wind, is forecast to grow from 7.5 quadrillion BTUs to 17.5 by 2050. Even then it’ll still provide less than half the energy of natural gas.

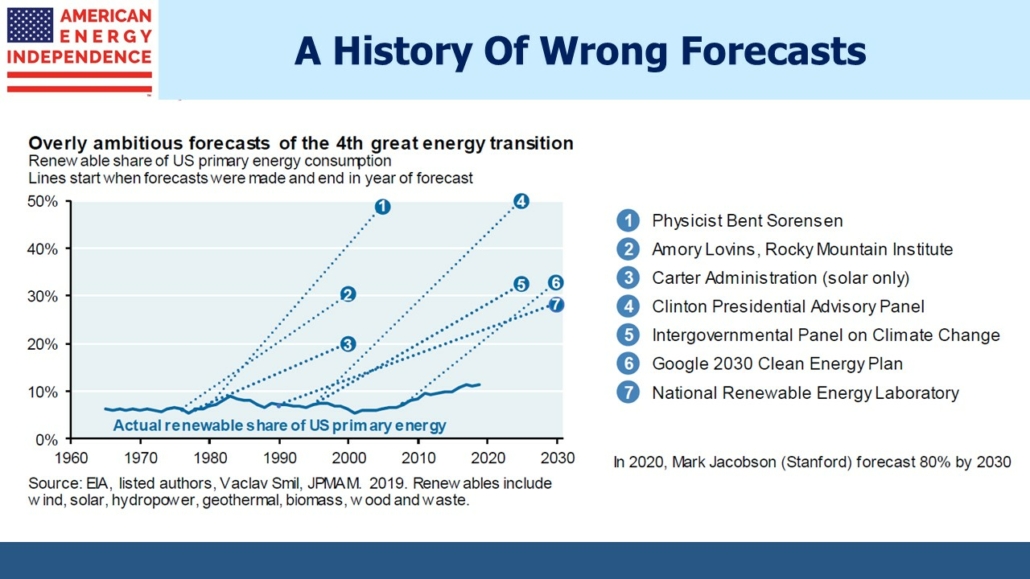

Energy transitions are slow, and forecasters have a long history of overestimating the speed of change. Just over four years ago we noted Tony Seba’s forecast (see A Futurist’s Vision of Energy) that by 2030 US consumers would only be buying Electric Vehicles (EVs). Their share is currently around 4%, with Tesla dominating. Although we expect EVs to grow like most forecasters, reaching one third market share (defined to include hybrids) as expected by LMC Automotive seems more realistic. Electricity produced from natural gas will still be the dominant source of power generation. Incidentally, Exxon Mobil’s 2030 EV market share forecast back in 2017 was 10% — likely to be low. Forecasting adoption rates for new technology is hard.

Near term market direction will depend on the Omicron variant. Over a year or more, we still expect the constructive fundamentals of the US energy sector, especially natural gas, to drive cash flows and stock prices higher.

Join us on Thursday, December 16th at 12 noon Eastern for a webinar where we’ll provide an update on the midstream sector during rising inflation.

Please see important Legal Disclosures.

The post The Emergence Of Omicron Covid appeared first on SL-Advisors.