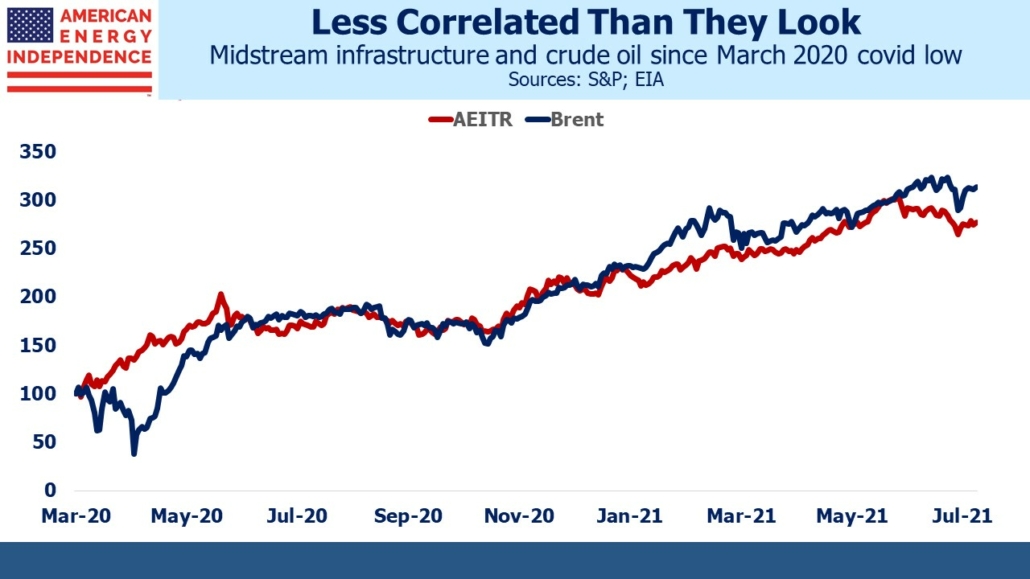

The link with crude oil is a familiar topic for investors in pipelines, who have often been told that the two are uncorrelated only to experience both inconveniently plunging together.

Since the Covid bottom in March, crude oil and midstream energy infrastructure have conveniently tracked each other higher – until the last several weeks during which the sector has slid while crude oil has held its gains. Visually, the last 16 months looks as if the two are closely linked. But the correlation of daily returns over that period is surprisingly low at only 0.28.

Episodes such as April 2020, when the two diverged sharply as crude went briefly negative, have an outsized impact on this statistic. As we’ve also noted, 2020 operating performance for most big pipeline companies came in within a few % of pre-Covid operating performance. It remains the case that stock prices move far more with oil than cash flows.

Episodes such as April 2020, when the two diverged sharply as crude went briefly negative, have an outsized impact on this statistic. As we’ve also noted, 2020 operating performance for most big pipeline companies came in within a few % of pre-Covid operating performance. It remains the case that stock prices move far more with oil than cash flows.

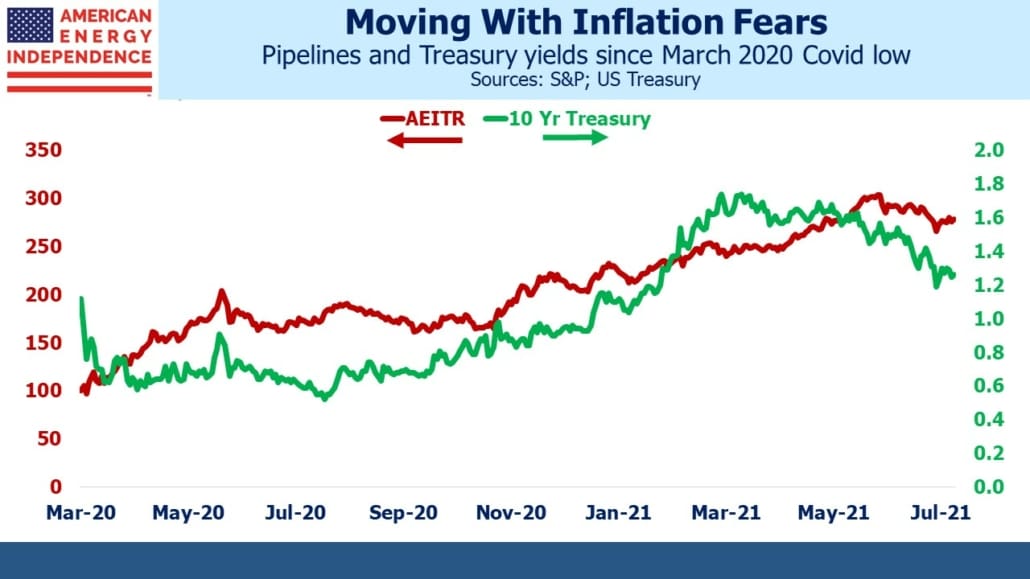

One reason for the relative weakness in midstream recently has been the drop in bond yields. The rise in inflation expectations increased interest in businesses with pricing power, and many pipelines have agreements that link price hikes to PPI. The ability to increase prices with inflation used to be an attractive feature years ago when MLPs were bought for their stable yields.

The volatility ushered in by the Shale Revolution took focus elsewhere, but this feature of contracts has remained and will likely become more important in the years ahead. In research last month (see Market Underprices Rate Hike Risks), Wells Fargo calculated that 60% of midstream EBITDA was exposed to inflation escalators, and with a 5.5% 2021 PPI estimate they calculated a 3% lift to sector EBITDA.

The recent moderation in inflation fears reflected in lower bond yields has similarly depressed the pipeline sector. This is likely to be temporary. As we noted last week, Fed bond buying took up almost all available net new supply in July (see Behind The Fed’s Benign Inflation Outlook). Inflation concerns are everywhere, with both fiscal and monetary policy being managed without regard to rising prices. The government will get what it wants, and the coincident drop in bond yields and pipelines serves to confirm the latter’s use as protection against inflation.

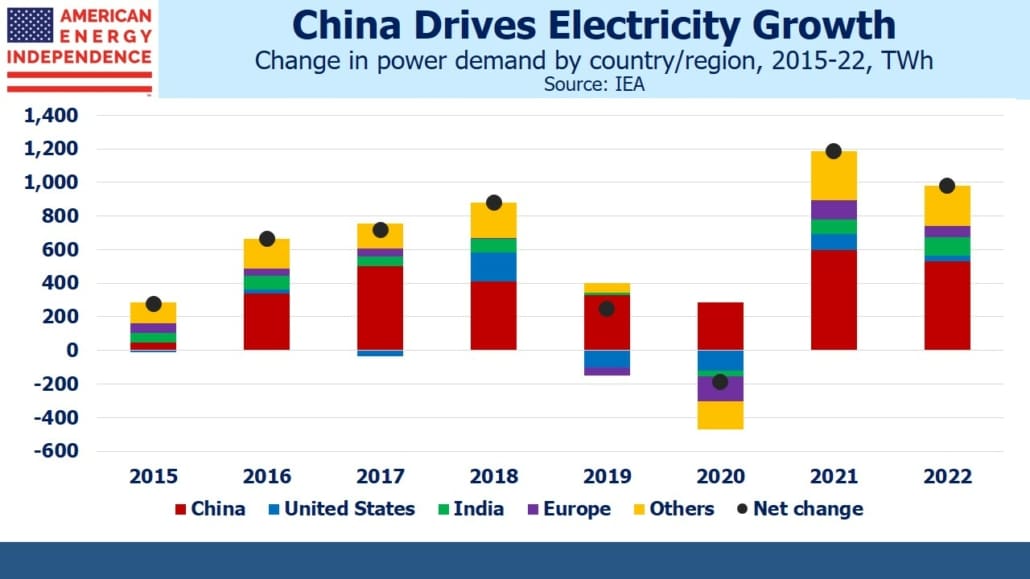

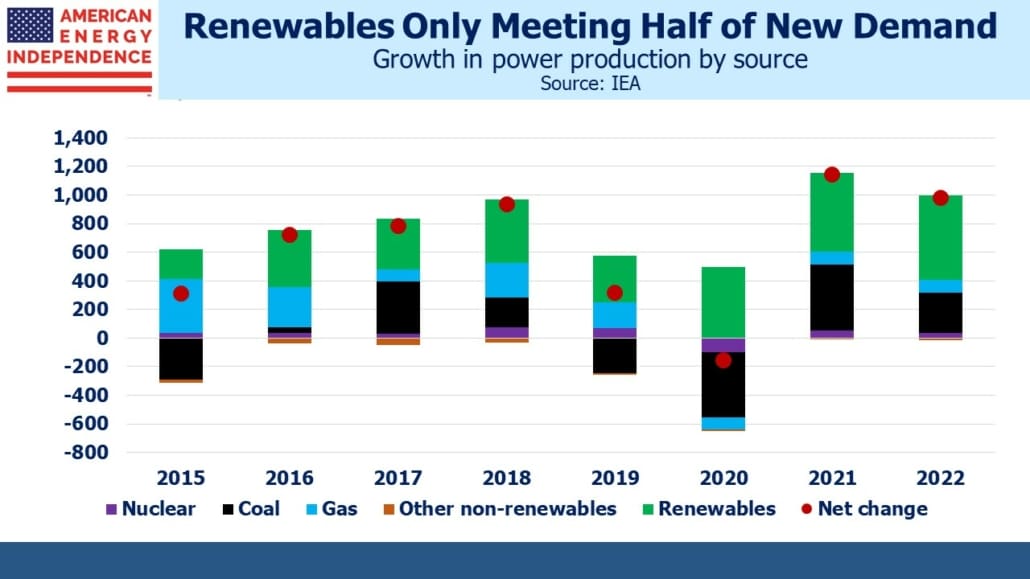

On a different topic, the International Energy Agency (IEA) recently issued a report on global electricity demand growth. It’s easy to conclude that renewables will soon be providing the majority of our power based on today’s popular press. The IEA noted that global electricity demand is increasing faster than renewables-supplied power. Since the power sector is renewables’ most important target, inability to even match demand growth reveals how unrealistic it is to think windmills and solar panels are going to fully solve the problem of climate change.

Moreover, because the growth in global electricity demand is centered in emerging Asia where coal use is high, this dirtiest form of energy is benefitting from strong demand. China represents half the worlds’s growth in power demand. Even last year they saw healthy growth, contrasting with widespread reductions due to Covid.

40% of this year’s growth in electricity demand will be provided by coal. China’s refusal to agree to a G20 communique phasing out coal is easily understood when considered alongside these figures from the IEA.

Even though coal continues to retain its outsized share of world electricity production, the opportunity for natural gas to offer a meaningful alternative remains immense.

Tellurian CEO Charif Souki mentioned this in a recent video. Confirming the positive long term outlook for natural gas, Shell became the third company to sign up with Tellurian to purchase 3 million tons per annum of natural gas.

The American Energy Independence Index (AEITR) includes North America’s biggest pipeline companies. We believe the sector offers solid inflation protection as well as continued upside from growing global demand for US natural gas.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

The post Pipelines Still Linked With Inflation appeared first on SL-Advisors.