At Berkshire’s virtual annual meeting recently, Warren Buffett mused that their cash hoard of $135BN didn’t seem that much. Stanley Druckenmiller said, “The risk-reward for equity is maybe as bad as I’ve seen it in my career.” The New Yorker thinks stock investors have lost their minds.

To not be bearish is to be insensitive – as if to dismiss the deaths and pandemic as economically meaningless.

Being negative is easy. Just think of all the closed stores, restaurants and sports events that have dramatically reduced options for leisure. I rarely need to visit the ATM because all I’m buying is gasoline, about once a month. It’s cheaper too, although I’d need to drive to a couple of planets for the savings to offset recent losses on my energy investments.

The S&P500 is -8% for the year, a performance seemingly divorced from reality. Following last year’s +31.5%, it might have been down 8% without coronavirus.

From a top-down perspective it’s usually easy to be bearish. There’s always something to worry about. But S&P500 earnings are estimated to be -20% this year and +27% in 2021, taking them back above last year’s. This is based on analyst estimates from early May, so for the most part reflects first quarter earnings and full year guidance. It’s hard to reconcile with the jump in the unemployment rate from 4.4% to 14.7%, but we must assume that’s incorporated in all those earnings forecasts.

The Equity Risk Premium (ERP, S&P500 earnings yield minus ten year treasury yield) still makes stocks look reasonably attractive. This is partly because interest rates are so low. But even if ten year treasury yields move up to 2% next year, equal to the Fed’s long term inflation target, the expected rebound in earnings will compensate.

If in fact earnings do rebound as forecast, it’s hard to see interest rates staying this low. For years bond investors have seemingly held a less optimistic view than equity investors, but the dichotomy seems as stark as it’s ever been.

To illustrate, Williams Companies (WMB) issued ten year debt at a yield of 3.56%, substantially below the dividend yield on their shares of 8.2%. Like many big pipeline companies, quarterly earnings were better than expected (see More Solid Pipeline Results). WMB’s quarterly payout is up 5.3% year-on-year.

Although the ERP shows stocks to be cheap, Goldman’s forecast of $44 in 2020 S&P500 dividends is only a 1.5% yield .

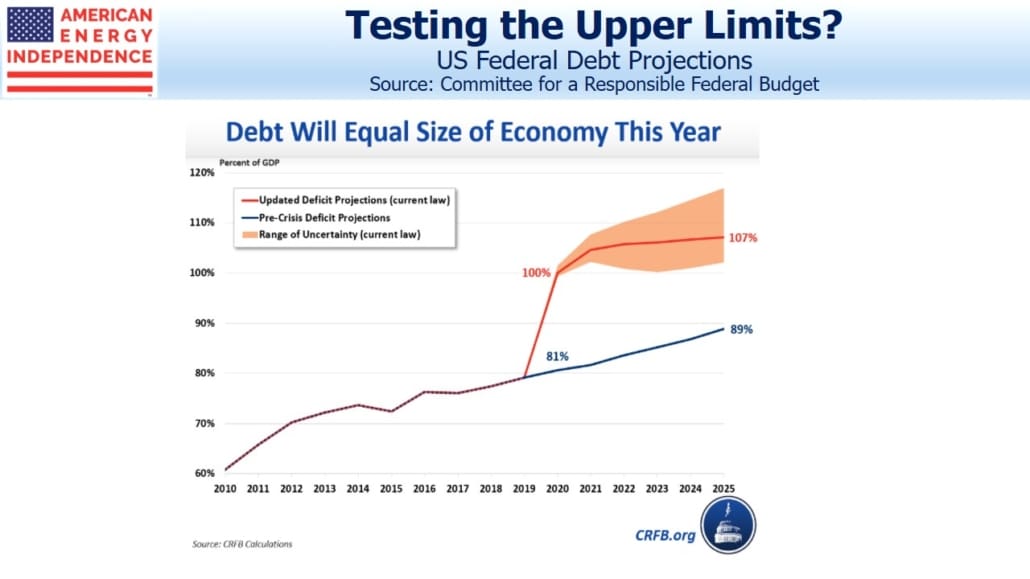

We’re heading into a period with no obvious historical precedent. A shut down of large swathes of the economy along with a big increase in debt is most analogous to war. The Committee for a Responsible Federal Budget now expects a Federal deficit of $3.8TN (versus $1.1TN pre-Coronavirus). They expect total Debt:GDP to reach 107% by 2023, exceeding the prior record of 106% hit just after the end of World War II. And these figures exclude any new Federal spending, although the House of Representatives recently passed another $3TN package.

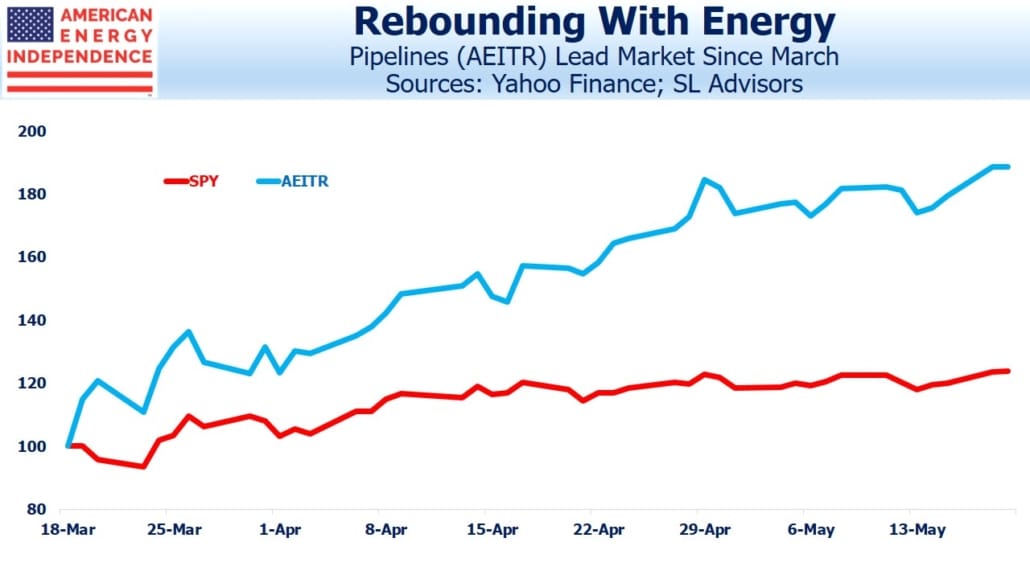

Given the dismal fiscal outlook, the stock market’s recent performance is even more impressive. And if you’re looking for a sector that’s rebounded nicely but is still down over 30% for the year, check out the pipeline sector.

The post Stocks Look Past The Recession and Growing Debt appeared first on SL-Advisors.