Company Description

Founded in 2011, STORE Capital is an internally managed net-lease real estate investment fund (or REIT) in the acquisition, investment and management of Single Tenant Operation Real Estate (or STORE Properties). STORE Capital has an investment portfolio across the United States in sectors including service, retail and industrials. STORE was indirectly controlled by Oaktree Capital Management L.P. prior to its exit in 2016.

Business Model

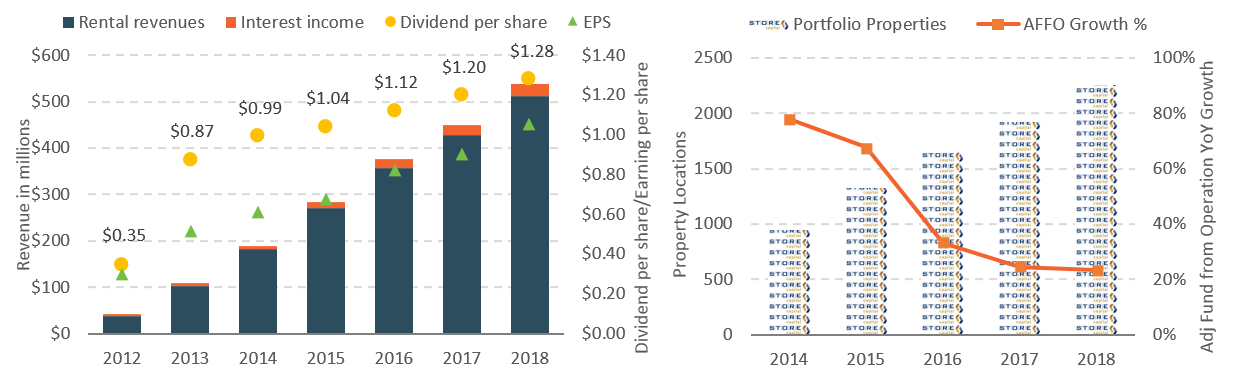

STORE Capital generates both rental revenues and interest income.

IPO History

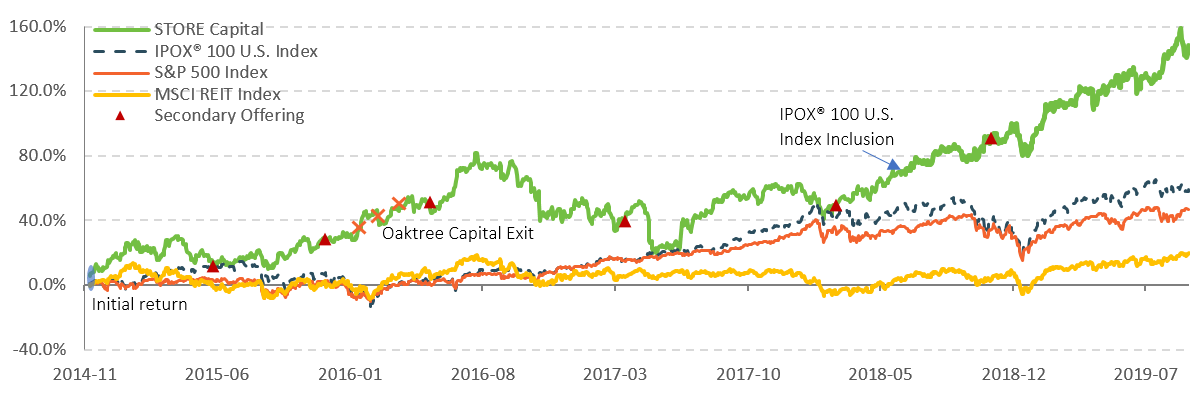

On 11/18/2014, STORE Capital launched the REIT offering on NYSE led by Goldman Sachs, Credit Suisse and J.P. Morgan. The share was priced at $18.50 per share, little above the middle of its expected range of $17 to $19 per share. With a full subscription of 27.5 million shares offered, and an additional 15% over-allotment option fully exercised, STORE Capital was valued at approximately $2.05 billion at offer. The stock opened at $19.65/share and finished the first day at $19.5. STORE Capital was included in the IPOX® 100 U.S. Portfolio on 06/15/2018 and currently weighs approximately 0.5% of the portfolio.

Historical Performance

Growth Outlook

Industry Comparison

[table id=20 /]