Company Description

Hamilton Lane, Inc.

Incorporated in 2007, Hamilton Lane Inc. is an affiliate of Hamilton Lane Advisors (HLA), an independent alternative investment management firm specializes in the private markets investing founded in Philadelphia in 1991. The company has approximately $64 billion of asset under management (AUM) and $409 billion of asset under advisement (AUA) as of date.

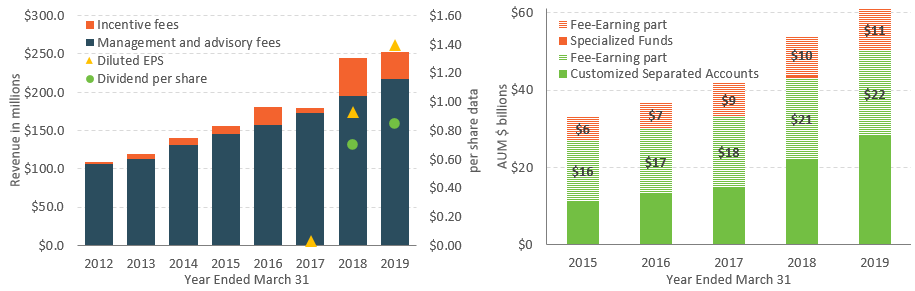

Business Model

Hamilton Lane generates revenues primary from a) management fees from specialized funds and customized separate account based on a contractual rate applied to AUM, b) advisory fees from services such as advisory, monitoring and reporting provided on investment portfolios and c) incentive fees such as carried interest earned and performance fees earned.

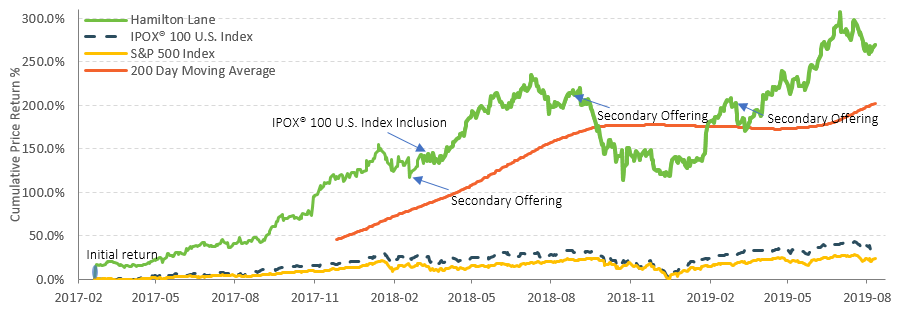

IPO History

On 03/01/2017, Hamilton Lane listed on NASDAQ led by J.P. Morgan and Morgan Stanley. The IPO was priced at $16.00 per share, the mid-range. With a full subscription of 11 ,875,000 Class A common stocks offered and an additional 15% over-allotment option fully exercised, Hamilton Lane was valued at approximately $750 million at offer. The stock opened at $17.85/share and closed the first day higher at $18.02.

Historical Performance

Growth Outlook

Industry Comparison

[table id=16 /]