Markets Gone Wild: Income Segment’s Rollercoaster Ride in April 2025!

April 2025 delivered a dramatic episode in what has already been a year marked by heightened volatility and shifting macroeconomic crosscurrents. After a rocky first quarter, equity markets in April embarked on what Treasury Secretary Bessent aptly described as “a round trip to nowhere,” with sharp swings ultimately leaving major indices little changed for the month. This high volatility was evident across the HANDLS Monthly Income strategies, which saw the Indexes post negative monthly returns, erasing much of the modest progress made earlier in the year.

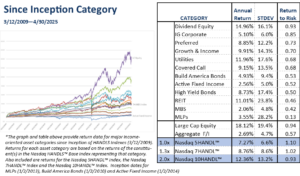

Covered call strategies, typically favored for their income-generating potential in sideways markets, underperformed in this environment. This relative weakness reflects the challenge for covered call strategies when volatility is driven by sharp, unpredictable moves as the lack of clear direction limited opportunities to capture upside. Master Limited Partnerships (MLPs) also struggled in April, declining a steep -7.7% for the month, though they remain up 2.1% year-to-date. Like covered calls, MLPs are often sought for their high-income potential, but their performance was hampered by sharp price swings and sector-specific headwinds.

Meanwhile, the broader equity market’s “long road to flat” was underscored by Secretary Bessent’s observation that, despite headline-grabbing rallies and sell-offs, investors ended the month much where they began. Fixed income allocations within the HANDLS framework provided some ballast, with core bond categories such as investment grade corporates and MBS posting modest gains for the month.

On the macro front, inflation surprised to the downside, with the latest reading coming in at 2.4% year-over-year, below consensus expectations. At the same time, Q1 GDP contracted by 0.3% on an annualized basis, raising questions about the durability of the economic expansion. These developments have prompted speculation about a potential shift in the Federal Reserve’s narrative, with markets increasingly anticipating a dovish pivot should growth concerns persist.

In sum, April’s market action reinforced the importance of diversification and risk management. As volatility remains elevated and macroeconomic signals grow more mixed, strategies like HANDLS that blend income and growth across asset classes are well-positioned to navigate the uncertain road ahead.

Disclosure: Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2025. Nasdaq, Inc. All Rights Reserved

Important Disclosure. HANDLS Indexes receives compensation in connection with licensing its indices to third parties. Any returns or performance provided within are for illustrative purposes only and do not demonstrate actual performance. Past performance is not a guarantee of future investment results. It is not possible to invest directly in an index. Exposure to an asset class is available through investable instruments based on an index. HANDLS Indexes does not sponsor, endorse, sell, promote or manage any investment fund or other vehicle that is offered by third parties and that seeks to provide an investment return based on the returns of any index. There is no assurance that investment products based on an index will accurately track index performance or provide positive investment returns. HANDLS Indexes is not an investment advisor, and HANDLS Indexes makes no representation regarding the advisability of investing in any such investment fund or other vehicle. A decision to invest in any such investment fund or other vehicle should not be made in reliance on any of the statements set forth in this document. Prospective investors are advised to make an investment in any such fund or other vehicle only after carefully considering the risks associated with investing in such funds, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the investment fund or other vehicle. Inclusion of a security within an index is not a recommendation by Indexes to buy, sell, or hold such security, nor is it considered to be investment advice. The information contained herein is intended for personal use only and should not be relied upon as the basis for the execution of a security trade. Investors are advised to consult with their broker or other financial representative to verify pricing information for any securities referenced herein. Neither Indexes nor any of its direct or indirect third-party data suppliers or their affiliates shall have any liability for the accuracy or completeness of the information contained herein, nor for any lost profits, indirect, special or consequential damages. Either Indexes or its direct or indirect third-party data suppliers or their affiliates have exclusive proprietary rights in any information contained herein. The information contained herein may not be used for any unauthorized purpose or redistributed without prior written approval from HANDLS Indexes. Copyright © 2025 by HANDLS Indexes. All rights reserved.