The first quarter was challenging for risk assets in general as investors wrestled with the economic impacts of the COVID-19 driven shutdown. The S&P 500 was down -20% in 1Q for the biggest quarterly decline since 2008. The investment grade convertible bond universe outperformed the S&P as one would expect. However, it is interesting to note that the more defensive sectors of the convertible bond universe underperformed expectations. This was driven by the inability of investors to sell more illiquid fixed income strategies, which resulted in the indiscriminate selling of liquid, exchange traded strategies. In our view, the recent underperformance of investment grade convertible bonds and preferreds creates a compelling entry point and we are constructive on the strategy for longer-term investors.

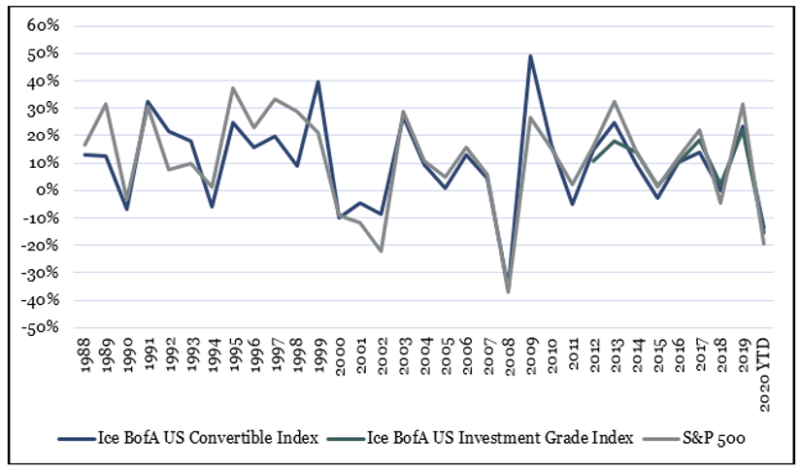

During the sell-off, converts held up relative to equities but underperformed our expectations given our historical experience with the asset class. The following chart compares the investment grade convertible bond asset class to the S&P.1

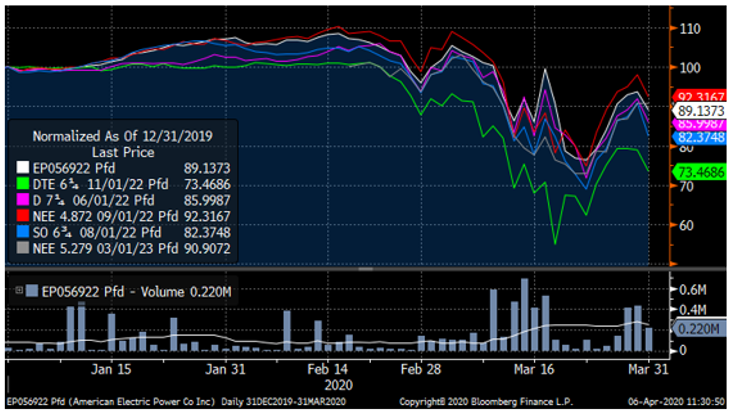

Convertible bond investors would use the colloquial rule of thumb that converts historically offered 2/3 of the S&P upside with 1/3 of the downside. Although converts participated nicely in the bull market of 2019 (asset class return of +23.15%), the asset class did not offer the traditional downside protection during the recent draw down. In fact, it was the more “defensive” names such as utilities that proved to be not so defensive. The fixed income markets experienced particular stress during the sell-off driven by concerns over liquidity. More liquid, exchange traded strategies became sources of funds as investors could not exit positions in less liquid vehicles like bank loans, MBS, CMBS, and levered loans. Our conversations with multiple trading partners during the quarter illuminated the fact that many funds were selling “what they could” in attempt to raise cash. An example of this trading behavior is illustrated by examining the following graph of several utility preferreds.

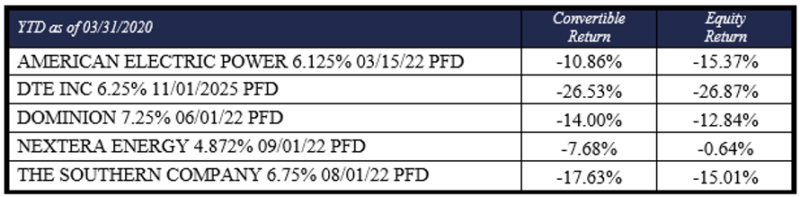

The high correlation among the names portrays an obvious trend. Investors treated all these companies similarly and more like an asset class than individual securities. Fundamentals were seemingly irrelevant as investors raised cash where they could rather than where there were obvious fundamental concerns. The cash flow and earnings streams of utilities ought to hold up much better in recession than those of other sectors like consumer discretionary and some areas of technology. What is more interesting to us is juxtaposing the performance of the preferred with that of the underlying equity.

As the table above depicts, the equity’s return matched or substantially beat the preferred’s return four out of five times in the down tape. The preferreds are senior in the cap structure to the underling equity and thus theoretically safer than the equity. Moreover, the preferred securities offer higher income streams in all cases. We believe this remains a short-term liquidity driven phenomenon and should reverse as markets normalize following extensive monetary intervention by the Federal Reserve. The central bankers are focused on fixing market liquidity, not solvency, so many of these distortions should revert in time.

In addition to liking our defensive yield plays, we are also particularly constructive on our small and mid-cap disruptive innovators which are taking market share and are even more attractive to strategic and private equity buyers. We remain bullish on the fundamentals of these companies and will add to positions on continued weakness.

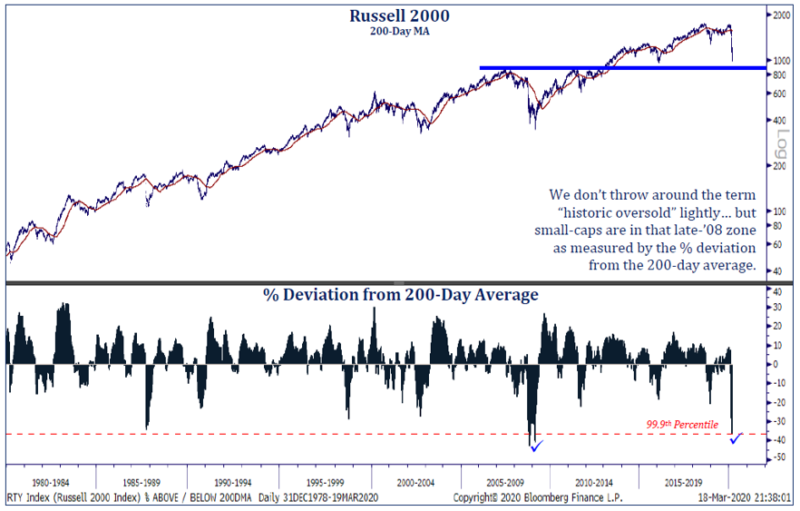

Small cap stocks declined even more (as depicted in the chart below), which we believe creates an interesting opportunity.

We attribute the relative underperformance of small caps to investor concerns over access to capital and sustainability of business models. A deeper analysis suggests that much of this fear is misplaced and that the market has been overly punitive to small cap companies with strong balance sheets and recurring revenue business models.

We focus on identifying companies that are disrupting their industries and demonstrating above market revenue growth. In addition, we look to identify companies that generate positive cash flow and are also in a position to scale back investments should we enter a prolonged downturn and need to preserve resources.

In addition to having great technologies, we focus on finding companies with great business models. Over 60% of our companies have a business model with an annuity or subscription component which should provide revenue stability during this downturn. Our software companies with SaaS models will continue to grow wallet share as companies embrace cloud computing to increase efficiencies. Some of our companies, like our cloud security vendors, telemedicine companies, and online education, are actually benefitting now from the shelter at home/work from home trends. As large and small companies re-engineer business practices post the COVID19 shutdown, many of our companies will provide the tools to facilitate new business and educational practices. We continue to believe that faster growing small cap names will begin to outperform when markets recover as valuations revert to higher multiples than the relatively slower growing large cap names.

Finally, we should continue to see M&A activity driven by cash rich private equity firms and innovation hungry larger cap companies. The current political landscape is pushing back on larger companies paying dividends and implementing stock buybacks. It seems obvious that inorganic growth and external innovation will be an increasingly primary use of excess cash. Our research team has identified 37 innovators, which were acquired since October 2013.2 In our experience, both larger industry strategic buyers and private equity firms tend to be more aggressive following market pullbacks on growth scares. We believe the recent COVID-19 related sell off will lead to more industry consolidation and PE deals over the foreseeable future.

1 Convertible bond asset class represented by the Ice BofA US Convertible Index (VXA0)

2 Not all acquisitions are profitable, the Fund’s positions can be acquired at a price that is less than the price at which the Fund purchased its interest. The issuer information is being shown to reflect the managers ability to select investments that are likely to be acquisition targets and not to reflect any positive investment experience